POST-MARKET SUMMARY 1st October 2025

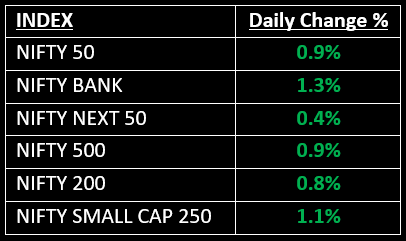

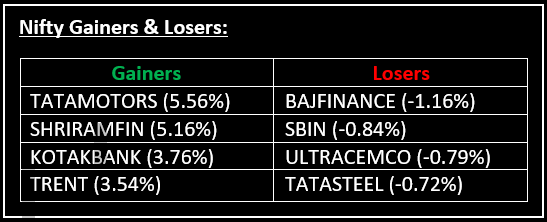

On October 1, Indian benchmark indices ended their 8-day losing streak with a strong performance, as the Nifty closed above 24,800. Top Gainer: TATAMOTORS | Top Loser: BAJFINANCE

On October 1, Indian benchmark indices ended their 8-day losing streak with a strong performance, as the Nifty closed above 24,800. This followed the RBI's decision to maintain the repo rate at current levels, in line with market expectations. Additionally, the RBI lowered its inflation forecast to 2.6% and revised its GDP growth projection upwards to 6.8%.

While the repo rate decision was anticipated, the RBI also announced a series of market-friendly measures aimed at expanding bank lending to capital markets. Read more: RBI unveils market-friendly measures.

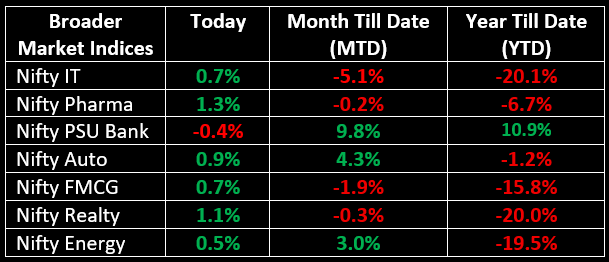

In the broader market, the BSE Midcap index gained 0.9% while the Smallcap index rose 1.2%. All sectors, except PSU Banks, ended in the green, with Private Banks, Realty, Pharma and Media sectors advancing by 1-4%.

The market will remain closed on October 2 due to Mahatma Gandhi Jayanti and Dussehra.

NIFTY: The index opened flat at 24,620 and made a high of 24,867 before closing at 24,836. Nifty has formed a long bullish candle on the daily chart. Its immediate resistance level is now placed at 24,890 while its immediate support is at 24,790.

BANK NIFTY: The index opened flat at 54,653 and closed at 55,347. Bank Nifty has formed a long bullish candle on the daily chart. Its immediate resistance level is now placed around 55,500 while immediate support is around 55,250.

Stocks in Spotlight

▪ Shriram Finance: Stock jumped 5% after a news report said Japan's Mitsubishi UFJ Financial Group (MUFG) is in advanced talks to acquire a 20% stake in the company..

▪ HG Infra Engineering: Stock jumped by over 3% after the company secured a Rs 925 crore contract for the Varanasi–Kolkata highway project.

▪ Indian Renewable Energy Development Agency: Stock gained over 2.5% after the company reported an 86% jump in loans sanctioned to Rs 33,148 crore for Q2. Additionally, loan disbursements grew by 54% YoY, reaching Rs 15,043 crore.

Global News

▪ European shares advanced, with healthcare stocks leading the rally following a U.S.-Pfizer deal that alleviated uncertainty in the sector. However, concerns about a potential delay in the release of U.S. monthly jobs data lingered.

▪ Oil prices steadied after falling for two consecutive days, as investors weighed OPEC+ plans for a larger output hike next month. Data from the U.S. and Asia pointed to signs of waning demand.

▪ Gold prices surged to a new record high, driven by safe-haven demand following the U.S. government shutdown and growing expectations of a Federal Reserve rate cut this month.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and/or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.