POST-MARKET SUMMARY 1st February 2025

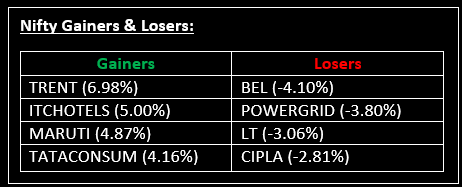

On February 1, Indian equity markets ended flat in a volatile session on Budget Day, despite significant announcements by Finance Minister Nirmala Sitharaman, including an income tax relief package. Top Gainer: TRENT | Top Loser: BEL

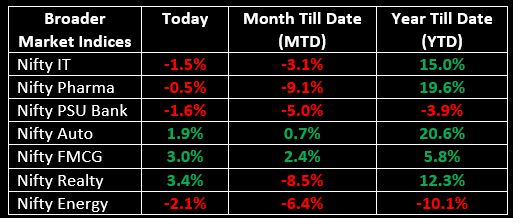

On February 1, Indian equity markets ended flat in a volatile session on Budget Day, despite significant announcements by Finance Minister Nirmala Sitharaman, including an income tax relief package. Sectorally, consumer durables rose 3%, realty added 3.3%, auto jumped 1.9%, media increased by 2%, and FMCG gained 3%. However, capital goods, power, and PSU indices shed 2-3%, while metal, IT, and energy sectors declined by 1-2%.

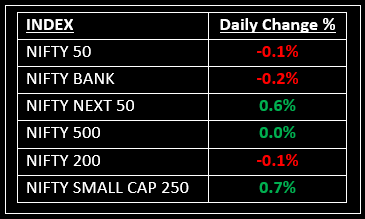

NIFTY: The index 148 points higher at 23,528 and made a high of 23,632 before closing at 23,482. Nifty has formed a small bearish candlestick pattern on the daily chart. Its major resistance level is now placed at 23,600 while support is at 23,350.

BANK NIFTY: The index opened flat at 49,592 and closed at 49,506. Bank Nifty has formed a High Wave-like candlestick pattern on the daily chart. Its major resistance level is now placed around 49,700 while support is around 49,000.

Stocks in Spotlight

▪ Easy Trip Planners: Stock surged over 6% following the budget's proposed boost for the tourism sector. The Finance Minister highlighted tourism as a key driver of employment-led growth, with plans to develop the top 50 tourist destinations in collaboration with state governments.

▪ IRB Infrastructure: Stock fell over 3% after the government decided to keep capital expenditure for highways unchanged in the budget. This move dampened investor sentiment towards the sector.

▪ Avanti Feeds: Stock gained nearly 3% following the Union Budget’s boost to shrimp stocks. The budget’s focus on the sector lifted investor sentiment towards the company.

Check out other stocks that made significant moves today: Budget 2025: Winners & Losers Revealed!

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and/or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.