POST-MARKET SUMMARY 1st February 2024

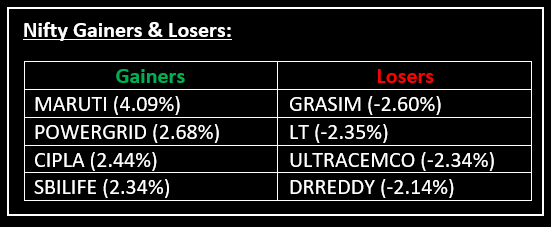

On February 1, the Indian equity benchmarks ended with little change in a volatile session after Finance Minister Nirmala Sitharaman presented the in-line Interim Budget with no big announcements. Top Gainer: MARUTI | Top Loser: GRASIM

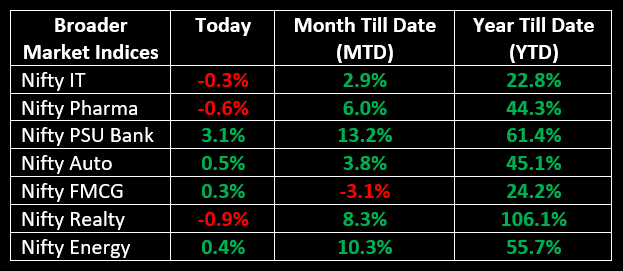

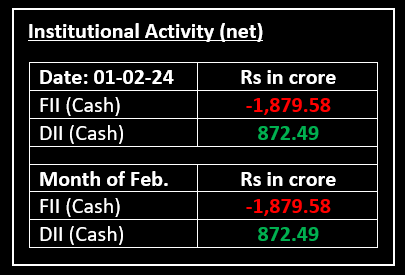

On February 1, the Indian equity benchmarks ended with little change in a volatile session after Finance Minister Nirmala Sitharaman presented the in-line Interim Budget with no big announcements. A mixed trend was seen on the sectoral front, with auto, bank, FMCG and power adding 0.2-0.8%, while capital goods, metal and realty were down a percent each. PSU Bank was the best-performing sector, gaining over 3%.

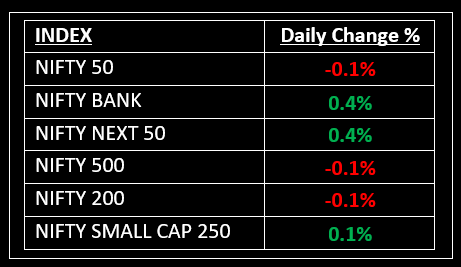

NIFTY: The index opened 55 points higher at 21,780 and made a high of 21,832 before closing at 21,697. Nifty has formed a bearish candlestick on the daily chart. Its immediate resistance level is now placed at 21,835 while immediate support is at 21,650.

BANK NIFTY: The index opened 168 points higher at 46,164 and closed at 46,188. Bank Nifty has formed a Doji candlestick on the daily chart. Its immediate resistance level is now placed at 46,300 while support is at 45,650.

Stocks in Spotlight

▪ Indian Overseas Bank: Stock gained 6% along with other PSU banks after the government announced lower than expected borrowing program in the budget.

▪ Paytm: Stock fell 20% and got locked in the lower circuit after RBI imposed major restrictions on the company's lending business, which also includes a prohibition on accepting fresh deposits and doing credit transactions after February 29.

▪ PB Fintech: Stock fell 1% after a block deal where 2.44 crore shares of the company changed hands on the stock exchanges.

Global News

▪ Gold prices oscillated on Thursday, weighed by a stronger dollar after the Federal Reserve resisted the idea of a rate cut in March, but bullion held its ground as investors continued to cling to the hope that interest rates would be trimmed later this year.

▪ The dollar hovered close to the highest level in seven weeks against the euro on Thursday.

▪ Global oil prices climbed in early trade on Thursday, supported by signals from the U.S. Federal Reserve on a possible start to rate cuts and as China unveiled new support measures for its embattled property market.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and/or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.