POST-MARKET SUMMARY 1st April 2025

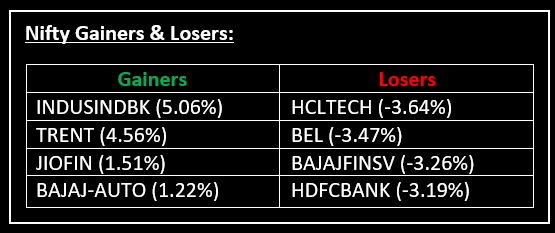

On April 1, equity indices continued their decline for the second consecutive session, marking a weaker start to the new financial year 2025-26. Top Gainer: INDUSINDBK| Top Loser: HCLTECH

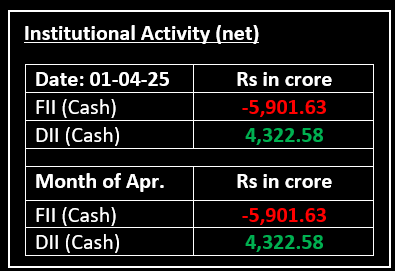

On April 1, equity indices continued their decline for the second consecutive session, marking a weaker start to the new financial year 2025-26. Market participants remained cautious ahead of the anticipated implementation of US President Donald Trump’s reciprocal tariffs on April 2. Despite mixed global cues, the market opened lower and initially saw some recovery, but the losses extended as the day progressed

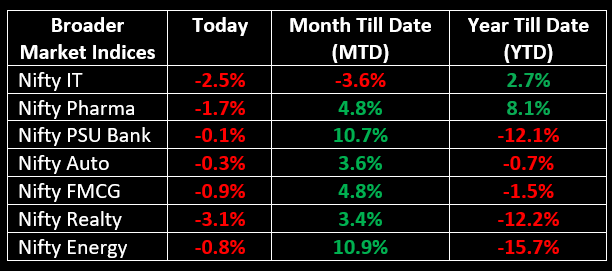

Sectorally, except for media (up over 2%) and oil & gas (up 0.08%), all other indices closed in the red. IT, realty, and consumer durables saw declines of 2-3% each.

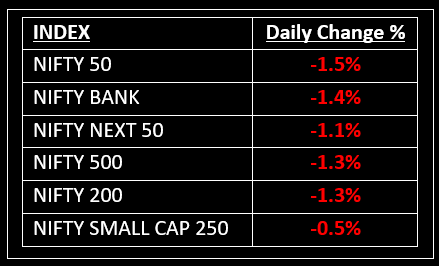

NIFTY: The index opened 178 points lower at 23,341 and made a high of 23,565 before closing at 23,165. Nifty has formed a bearish candlestick pattern with a long upper shadow on the daily chart. Its immediate resistance level is now placed at 23,260 while its immediate support is at 23,050.

BANK NIFTY: The index opened 386 points lower at 51,178 and closed at 50,827. Bank Nifty has formed a bearish candle on the daily chart. Its immediate resistance level is now placed around 51,200 while immediate support is around 50,500.

Stocks in Spotlight

▪ Transrail Lighting: Stock jumped over 5% following the announcement of a new ₹240 crore order for the construction of a transmission line in the international market.

▪ Trent: Stock rose close to 5% after the company announced to shareholders via an exchange filing that it had crossed the 1,000-store count milestone.

▪ SML Isuzu: Stock surged by over 7% after the company reported a nearly 24% year-on-year increase in total sales, reaching 2,315 units in March 2025, up from 1,868 units in the same period last year.

Global News

▪ Asian stock markets exhibited a mixed trend today, largely influenced by investor sentiment surrounding U.S. President Donald Trump's impending "Liberation Day" on April 2, when he is expected to unveil significant reciprocal tariffs.

▪ European shares rebounded on Tuesday after touching a two-month low in the previous session, although the sentiment remained cautious ahead of the impending U.S. reciprocal tariffs.

▪ Oil prices steadied near five-week highs on Tuesday as threats by U.S. President Donald Trump to impose secondary tariffs on Russian crude and attack Iran countered concerns about the impact of a trade war on global growth.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and/or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.