POST-MARKET SUMMARY 19th March 2024

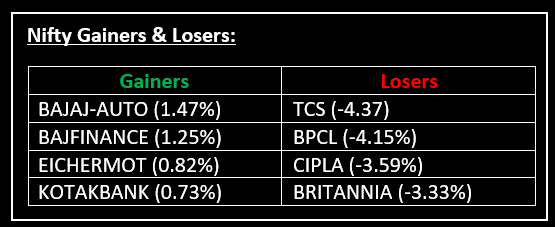

On March 19, despite experiencing a mild recovery in the preceding session, the BSE Sensex was heavily pulled into negative territory for 2024 by bearish sentiment. Top Gainer: BAJAJ-AUTO | Top Loser: TCS

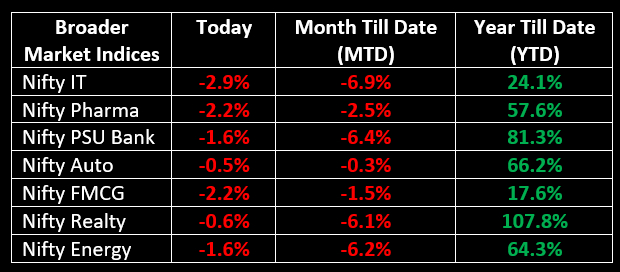

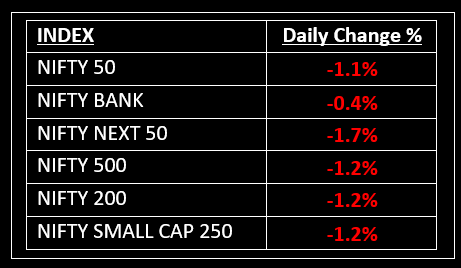

On March 19, despite experiencing a mild recovery in the preceding session, the BSE Sensex was heavily pulled into negative territory for 2024 by bearish sentiment. Opening on a negative note, the benchmark indices continued to decline throughout the day, with Nifty and Sensex dropping below 21,800 and 72,000, respectively, intraday, due to widespread selling across sectors. All sectoral indices closed in negative territory, with Healthcare, IT, FMCG, Capital Goods, Oil & Gas, and Power segments witnessing declines of 1-2%.

NIFTY: The index opened 109 points lower at 21,946 and made a high of 21,978 before closing at 21,817. Nifty has formed a long bearish candlestick pattern on the daily chart. Its immediate resistance level is now placed at 21,900 while immediate support is at 21,780.

BANK NIFTY: The index opened 154 points lower at 46,421 and closed at 46,384. Bank Nifty has formed a small-bodied bearish candlestick pattern with upper and lower shadows which resembles the Doji sort of candle on the daily chart. Its immediate resistance level is now placed at 46,750 while support is at 46,000.

Stocks in Spotlight

▪ Lemon Tree Hotels: Stock gained in the opening trade on March 19 after the company signed a license agreement for Lemon Tree Hotels Agartala, Tripura.

▪ TCS: Stock fell over 2% on March 19 as 2.02 crore shares or 0.6% equity changed hands at an average price of Rs 4,043 per share.

▪ Sonata Software: Stock were up more than 3% in the opening trade on March 19 after the company signed a joint Go-to-Market agreement with end-to-end IT solutions and cloud-managed services provider.

Global News

▪ European markets were flat Tuesday as global investors look ahead to the start of the U.S. Federal Reserve’s two-day policy meeting.

▪ Oil prices were largely steady on Tuesday near four-month highs after breaking above range-bound trading last week, but the prospect of rising exports from Russia weighed amid Ukrainian attacks on refineries.

▪ The Japanese yen tumbled on Tuesday after the central bank made the momentous, but widely anticipated, decision to end its negative interest rate policy, while the dollar rose ahead of the upcoming Federal Reserve decision on rates.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and/or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.