POST-MARKET SUMMARY 19th June 2025

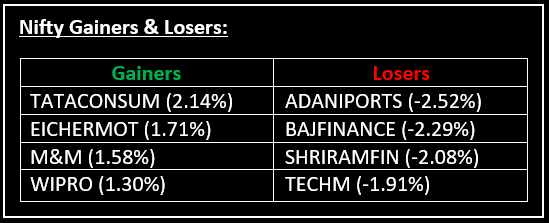

On June 19, Indian equity indices ended marginally lower in another volatile session, with the Nifty closing below 24,800 amid widespread selling across most sectors. Top Gainer: TATACONSUM | Top Loser: ADANIPORTS

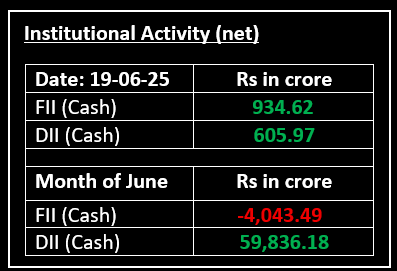

On June 19, Indian equity indices ended marginally lower in another volatile session, with the Nifty closing below 24,800 amid widespread selling across most sectors. After a flat-to-negative start, the market traded within a range throughout the day, reflecting mixed global cues following the US Fed’s decision to keep interest rates steady, while projecting higher inflation and slower growth. Rising geopolitical tensions in the Middle East further dampened investor sentiment.

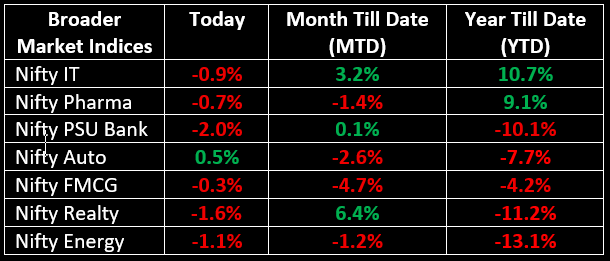

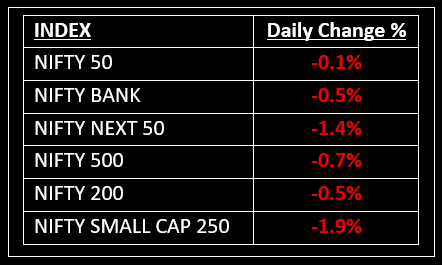

Broader indices underperformed the main indices, with the BSE Midcap and Smallcap indices both falling over 1.6%. Among sectors, all but auto and consumption ended lower, with IT, media, metal, realty, oil & gas, pharma, telecom and PSU Bank witnessing declines of 0.5-2%.

NIFTY: The index opened flat at 24,803 and made a high of 24,863 before closing at 24,793. Nifty has formed a small-bodied bearish candle on the daily chart. Its immediate resistance level is now placed at 24,880 while its immediate support is at 24,700.

BANK NIFTY: The index opened 44 points lower at 55,784 and closed at 55,577. Bank Nifty has formed a bearish candle on the daily chart. Its immediate resistance level is now placed around 55,800 while immediate support is around 55,350.

Stocks in Spotlight

▪ MTAR Technologies: Stock rose by over 1.5% after securing a 10-year contract with Switzerland-based Weatherford Products GMBH for the supply of Whipstock assemblies and other critical components.

▪ Puravankara: Stock jumped nearly 3% following a Rs 272 crore contract win by its subsidiary, Starworth Infrastructure & Construction, for a residential project in Bengaluru.

▪ ESAF Small Finance Bank: Stock closed 1.6% higher after the Board approved the sale of NPAs and technically written-off loans worth Rs 735.18 crore to an asset reconstruction company.

Global News

▪ European and Asian stock markets declined on Thursday, with sentiment dampened by escalating Middle East tensions and concerns over potential U.S. involvement.

▪ Crude oil prices surged after Israel confirmed airstrikes on Iranian nuclear sites in Natanz and Arak, fuelling fears of a wider conflict that could disrupt global crude supplies.

▪ Gold prices rose as investors sought the safety of the metal amid growing concerns over the Israel-Iran conflict, while platinum reached its highest level since September 2014.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and/or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.