POST-MARKET SUMMARY 19th July 2024

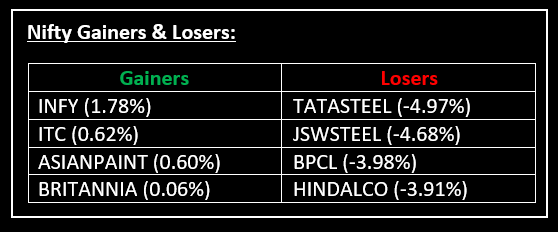

On July 19, benchmark indices Nifty and Sensex hit new record highs, extending gains for the fifth session in a row ahead of the Union budget. Top Gainer: INFY | Top Loser: TATASTEEL

On July 19, benchmark indices Nifty and Sensex hit new record highs, extending gains for the fifth session in a row ahead of the Union budget. This came just a day after the Sensex cruised past 81,000 and Nifty attained a new high of its own. However, soon after the opening, the frontline indices slipped into the red as investors booked profits.

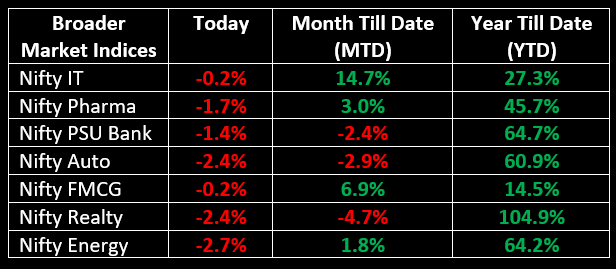

Among sectors, IT was the only one trading in the green, led by Infosys. LTIMindtree, HCL Tech, and TCS were other major contributors. The realty index was the worst hit, followed by the metal and energy indices.

In the primary market, Sanstar Ltd IPO garnered strong response on the first day of bidding. For detailed insights, read: Sanstar Ltd IPO: Key Insights & Analysis

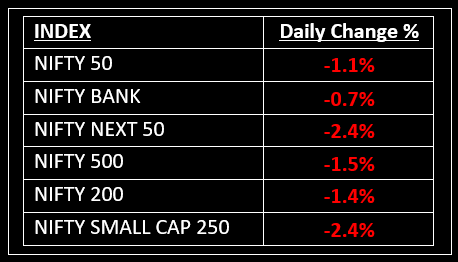

NIFTY: The index opened 53 points higher at 24,853 and made a high of 24,854 before closing at 24,530. Nifty has formed a long bearish candlestick, resembling a Bearish Engulfing pattern at the top on the daily chart. Its immediate resistance level is now placed at 24,600 while immediate support is at 24,440.

BANK NIFTY: The index opened 89 points lower at 52,531 and closed at 52,265. Bank Nifty has formed a bearish candlestick pattern on the daily chart. Its immediate resistance level is now placed at 52,500 while support is at 51,900.

Stocks in Spotlight

▪ Infosys: Stock soared 5% in early trade to hit a 52-week high, after the company beat analyst expectations of Q1 earnings and raised revenue growth guidance, signalling signs of recovery.

▪ Zydus Lifesciences: Stock fell 3% after the company's Jarod injectables manufacturing facility got classified as 'Official Action Indicated' (OAI) by the United States Food & Drug Administration.

▪ JSW Infrastructure: Stock plunged nearly 7% after the company reported an annual decline in its consolidated net profit for the quarter ended June, driven by higher expenses.

Global News

▪ Asia-Pacific markets fell on Friday, tracking Wall Street declines as investors continued to rotate out of tech stocks and take profits from the rally in equities in recent weeks.

▪ Oil prices were little changed on Friday as a strong dollar and concern over top oil importer China’s economy were countered by a tighter supply outlook.

▪ European markets were lower on Friday as investors reacted to the latest ECB interest rate decision and continued to deal with the repercussions of a global IT outage caused by problems at the cybersecurity firm CrowdStrike.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and/or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.