POST-MARKET SUMMARY 19th February 2024

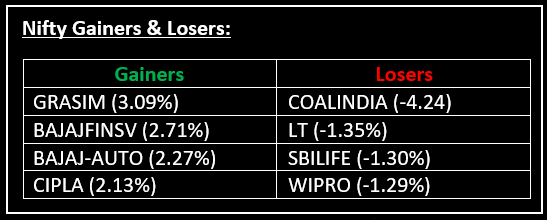

On February 19, the market continued its upward trajectory for the fifth consecutive session, closing near the day's peak as the Nifty reached a fresh all-time intraday high of 22,186.65. Top Gainer: GRASIM | Top Loser: COALINDIA

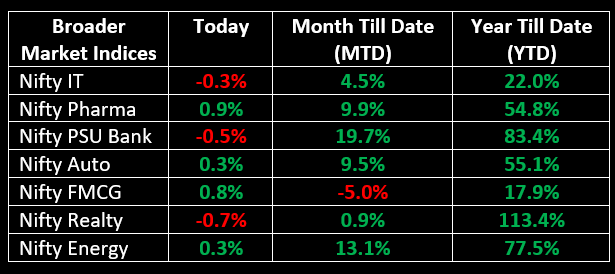

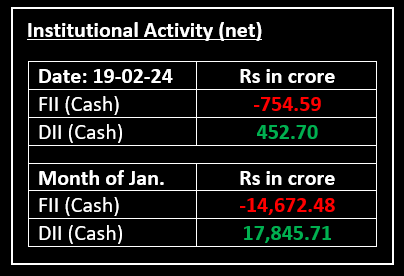

On February 19, the market continued its upward trajectory for the fifth consecutive session, closing near the day's peak as the Nifty reached a fresh all-time intraday high of 22,186.65. Despite mixed global cues, the market commenced positively, experiencing fluctuations between gains and losses initially. Nevertheless, robust buying in most sectoral indices and heavyweight stocks facilitated a close near the day's peak levels. In terms of sectors, capital goods, IT, metal, and realty concluded in negative territory, while auto, banking, FMCG, healthcare, oil & gas, and power registered gains ranging from 0.3% to 1%.

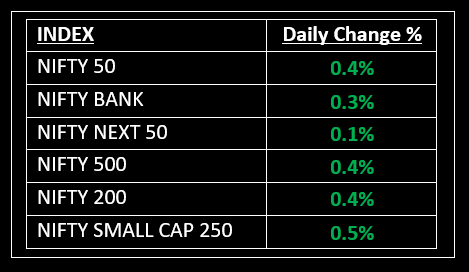

NIFTY: The index opened 63 points higher at 22,103 and made a high of 22,186 before closing at 22,122. Nifty has formed a small-bodied bullish candlestick on the daily chart. Its immediate resistance level is now placed at 22,180 while immediate support is at 22,060.

BANK NIFTY: The index opened 96 points higher at 46,554 and closed at 46,535. Bank Nifty has formed a Doji candlestick pattern on the daily chart. Its immediate resistance level is now placed at 46,700 while support is at 46,300.

Stocks in Spotlight

▪ RVNL: Stock surged 5.8% after the company said its order book grew to Rs 65,000 crore.

▪ Quess Corp: Stock soared 7.6% after the company announced it will split into three independent entities, a move aimed at unlocking shareholder value.

▪ Sula Vineyards: Stock fell 8% after a block deal worth Rs 676.6 crore took place in the counter.

Global News

▪ European stocks slipped on Monday, with French stocks taking a hit after the government cut its annual economic growth forecast.

▪ Oil prices edged lower on Monday morning as markets digested comments from U.S. Federal Reserve officials pointing to a more patient stance regarding potential interest rate cuts.

▪ Gold prices rose to a nearly one-week high on Monday as a slight pullback in the U.S. dollar and escalating tensions in the Middle East lifted the bullion’s safe-haven appeal.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and/or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.