POST-MARKET SUMMARY 19th December 2024

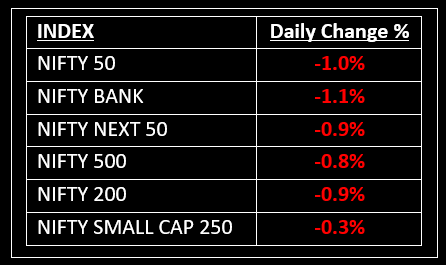

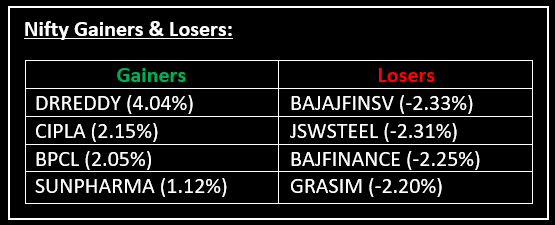

On December 19, India's benchmark indices, Sensex and Nifty, fell over 1%, marking their fourth consecutive decline as global market weakness impacted investor sentiment. Top Gainer: DRREDDY | Top Loser: BAJAJFINSV

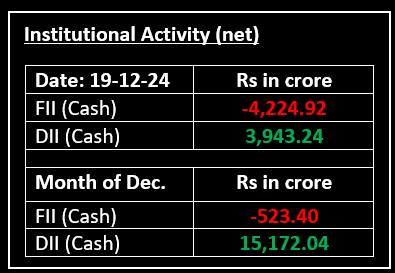

On December 19, India's benchmark indices, Sensex and Nifty, fell over 1%, marking their fourth consecutive decline as global market weakness impacted investor sentiment. The downturn followed the US Federal Reserve's cautious outlook, reducing its rate cut forecast for 2025 from four to two, which unsettled global markets. US indices dropped 2.5-3%, and major Asian markets opened sharply lower. The Fed's "wait-and-watch" approach, amid inflation risks and uncertainties over the incoming Trump administration's policies, further dampened market confidence.

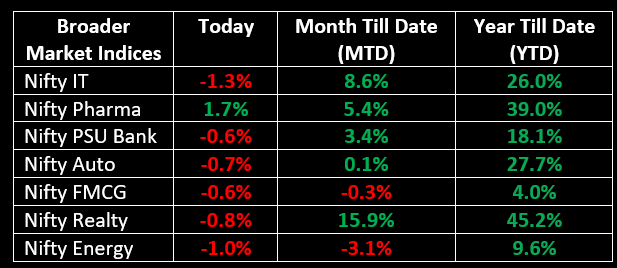

On the sectoral front, all indices except Pharma ended in the red, with auto, IT, metal, and realty sectors falling by 0.5-2%.

NIFTY: The index opened 321 points lower at 23,877 and made a high of 24,004 before closing at 23,951. Nifty has formed a bullish candlestick pattern with a minor upper wick on the daily charts. Its immediate resistance level is now placed at 24,000 while immediate support is at 23,870.

BANK NIFTY: The index opened 711 points lower at 51,428 and closed at 51,575. Bank Nifty has formed a long bullish candlestick pattern with both upper and lower shadows on the daily charts. Its immediate resistance level is now placed around 51,800 while immediate support is around 51,400.

Stocks in Spotlight

▪ Lupin: Shares gained over 3% after the drugmaker received approval from the US Food and Drug Administration for its generic HIV drug.

▪ Asian Paints: Shares settled 2% lower after two senior management executives, Shyam Swamy and Vishu Goel, announced their resignations with immediate effect.

▪ Stove Kraft: Shares settled 2.5% higher after the company announced selling cookware via IKEA's global stores.

Global News

▪ Gold prices gained more than 1% on Thursday, rebounding from a one-month low, as the market digested the U.S. Federal Reserve’s hint of a gradual policy easing next year, with investors awaiting more data to gauge the economy’s health.

▪ Oil prices fell in early trading on Thursday after the U.S. Federal Reserve signaled that it would slow the pace of interest rate cuts in 2025, potentially impacting fuel demand.

▪ European markets fell sharply on Thursday, following their global counterparts lower after the U.S. Federal Reserve indicated yesterday that fewer rates cuts are on the horizon.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and/or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.