POST-MARKET SUMMARY 19th August 2024

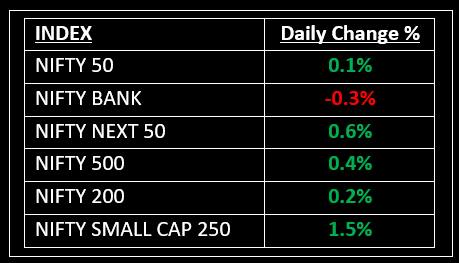

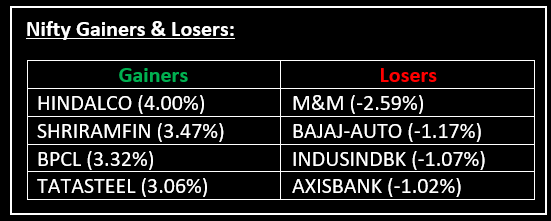

On August 19, Indian markets ended flat in a rangebound session. The Sensex dipped 12.16 points or 0.02% to close at 80,424.68 while the Nifty gained 31.50 points or 0.13% to settle at 24,572.70. Top Gainer: HINDALCO | Top Loser: M&M

On August 19, Indian markets ended flat in a rangebound session. The Sensex dipped 12.16 points or 0.02% to close at 80,424.68 while the Nifty gained 31.50 points or 0.13% to settle at 24,572.70. The market opened higher, with Nifty above 24,600 amid positive global cues but lost momentum in the initial hour, trading rangebound for the remainder of the session.

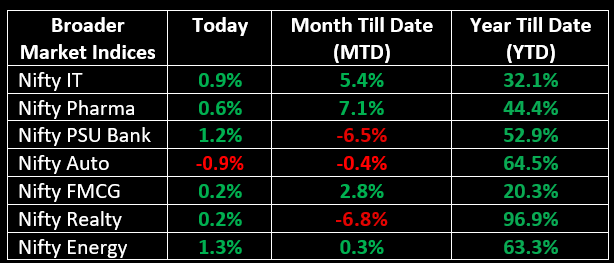

On the sectoral front, all indices except auto and bank closed higher, with gains of 0.5-2% in healthcare, IT, metal, oil & gas, power, telecom, and media. Meanwhile, Interarch Building Products launched its IPO in the primary market today. Click here for a comprehensive analysis of the IPO.

NIFTY: The index opened 95 points higher at 24,636 and made a high of 24,638 before closing at 24,572. Nifty has formed a small bearish candlestick pattern with a minor lower shadow on the daily chart. Its immediate resistance level is now placed at 24,640 while immediate support is at 24,520.

BANK NIFTY: The index opened 167 points higher at 50,683 and closed at 50,368. Bank Nifty has formed a bearish candle on the daily chart. Its immediate resistance level is now placed at 50,600 while immediate support is around 50,250.

Stocks in Spotlight

▪ Genus Power Infrastructure: Stock hit 5% upper circuit after the firm's wholly-owned subsidiary bagged three Letter of Awards worth Rs 3,000 crore.

▪ Glenmark Pharmaceuticals: Stock gained 4% after the company’s subsidiary launched Olopatadine Hydrochloride Ophthalmic Solution USP, 0.1% (OTC) for eye allergy treatment in the US.

▪ DCX Systems: Stock snapped a three-day losing run to hit an upper circuit of 5%, after the company received orders worth Rs 107.08 crore from both domestic and international customers.

Global News

▪ Gold prices eased on Monday after powering to an all-time high above the important $2,500 per ounce level in the previous session on strong safe-haven demand and expectations of an imminent U.S. rate cut as investors seek more cues on the quantum of cuts.

▪ The pan-European Stoxx 600 index was up 0.54% by 2:52 p.m. London time, with the majority of sectors and all major bourses trading in the green. Mining and retail stocks added 1.73% and 1.38% respectively.

▪ The yen rose sharply on Monday and the euro touched its highest this year as the dollar retreated broadly with traders bracing for dovish signals from Federal Reserve meeting minutes and Chair Jerome Powell’s speech at Jackson Hole.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and/or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.