POST-MARKET SUMMARY 18th September 2024

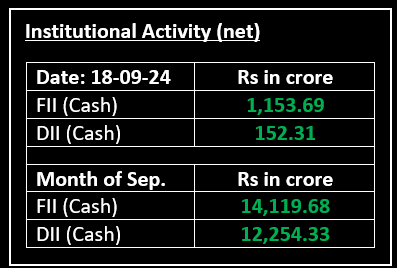

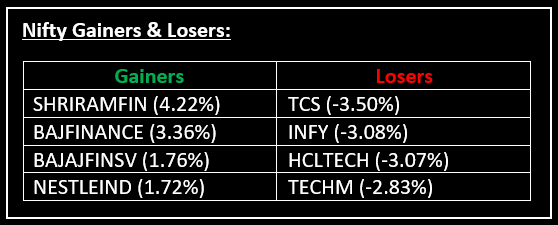

On September 18, Indian markets climbed to fresh record highs but failed to hold onto the gains, ending in negative territory as investors awaited the US Federal Reserve’s interest rate decision later in the day. Top Gainer: SHRIRAMFIN | Top Loser: TCS

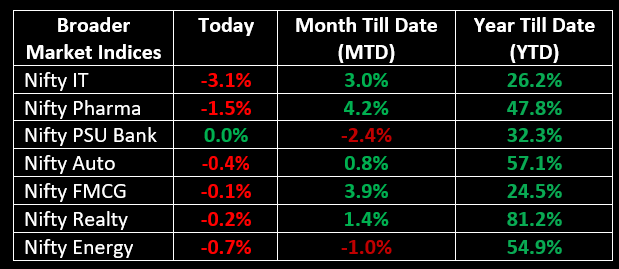

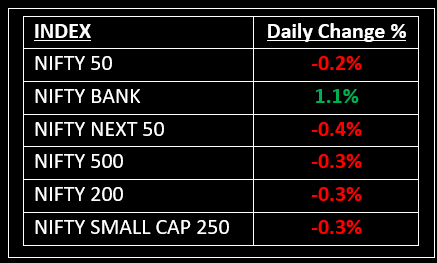

On September 18, Indian markets climbed to fresh record highs but failed to hold onto the gains, ending in negative territory as investors awaited the US Federal Reserve’s interest rate decision later in the day. After a weak start, the market rebounded to hit new highs, driven by banking stocks, but could not sustain the momentum in the second half, closing in the red due to selling across sectors, except banking. All other sectoral indices ended lower, with the IT index shedding more than 3%, while auto, pharma, metal, and oil & gas indices were down 0.5-1%.

NIFTY: The index opened flat at 25,402 and made a high of 25,482 before closing at 25,377. Nifty has formed a small bearish candlestick pattern with upper and lower shadows on the daily chart. Its immediate resistance level is now placed at 25,480 while immediate support is at 25,270.

BANK NIFTY: The index opened flat at 52,177 and closed at 52,750. Bank Nifty has formed a long bullish candlestick pattern on the daily chart. Its major resistance level is now placed at 52,950 while major support is at 52,450.

Stocks in Spotlight

▪ Reliance Infrastructure: Stock zoomed 20% after the company settled and paid its entire obligations with Edelweiss Asset Reconstruction Co Ltd (Edelweiss) concerning the Non-Convertible Debentures issued by the company. Read more: Why Anil Ambani’s ADAG Group Stocks Are Rising

▪ REC: Stock climbed over 3% after the company signed non-binding MOUs with Renewable Energy developers aggregating about Rs 1.12 lakh crore at the 4th Global Renewable Energy Investors Meet & Expo in Gujarat.

▪ Torrent Power: Stock surged over 9% after it received a Letter of Intent from Maharashtra State Electricity Distribution Company for procurement of 1,500 MW energy storage capacity from the Pumped Hydro Storage Project.

Global News

▪ Gold prices gained on Wednesday on a softer dollar amid investor caution ahead of the U.S. Federal Reserve’s policy decision, which is expected to start its monetary easing cycle.

▪ Asian markets traded mixed - Japan's Nikkei 225 gained 0.2% in afternoon trading while Australia's S&P/ASX 200 and Shanghai Composite index slipped 0.1%.

▪ The dollar surrendered some of its overnight gains against the yen on Wednesday, as investors tweaked their positions ahead of a policy meeting expected to initiate a U.S. easing cycle.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and/or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.