POST-MARKET SUMMARY 18th November 2024

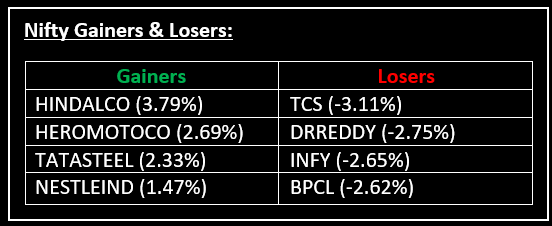

On November 18, the Nifty extended its decline for the seventh consecutive session, marking its longest losing streak since February 2023, as IT and Energy stocks faced sharp sell-offs. Top Gainer: HINDALCO | Top Loser: TCS

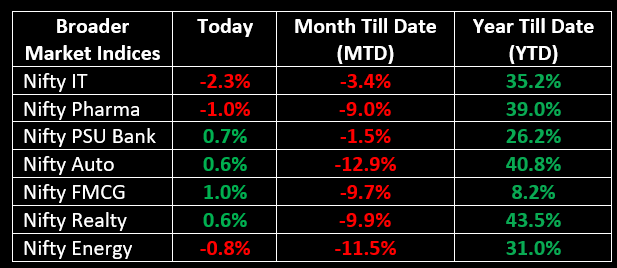

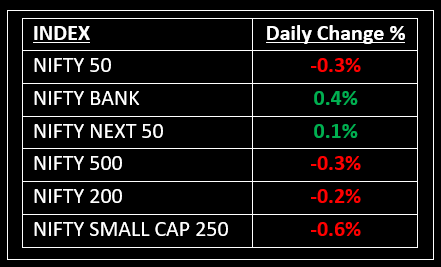

On November 18, the Nifty extended its decline for the seventh consecutive session, marking its longest losing streak since February 2023, as IT and Energy stocks faced sharp sell-offs. Among sectors, IT, Healthcare, and Energy declined by 0.8-2.3%, while Metal, Banking, and Auto rose 0.4-2%.

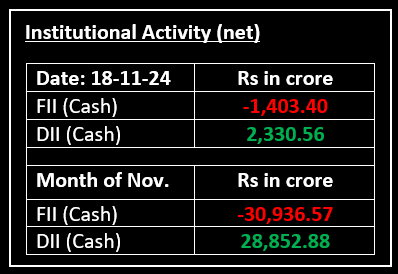

Market sentiment remained subdued, weighed down by concerns over a potential slowdown in US Fed rate cuts, disappointing Q2 earnings, sustained foreign outflows, and elevated valuations, leaving investors cautious.

NIFTY: The index opened 73 points higher at 23,605 and made a high of 23,606 before closing at 23,453. Nifty has formed a bearish candlestick pattern on the daily chart. Its major resistance level is now placed at 23,600 while major support is at 23,350.

BANK NIFTY: The index opened 133 points higher at 50,312 and closed at 50,363. Bank Nifty has formed formed a Doji candlestick pattern (though not a classical one) on the daily chart. Its major resistance level is now placed at 50,600 while major support is at 50,000.

Stocks in Spotlight

▪ Crompton Greaves: Stock gained 3.5% after reporting a 26% YoY rise in consolidated net profit and a 6.4% increase in revenue for the September quarter.

▪ NALCO: Stock jumped over 8% as China's move to cut export tax rebates on aluminium and copper raised expectations of tighter global supply and higher prices, benefiting metal producers.

▪ TCS: Stock slipped 3% as the Nifty IT index fell nearly 4%, following US Fed Chair’s remarks on delaying rate cuts amid robust economic growth and persistent inflation.

Global News

▪ The dollar rose against the yen after Japan's central bank indicated possible tightening, while the euro steadied after reaching a one-year low.

▪ Asian stocks were mixed on Monday as markets began a "quiet" week for economic data, with key figures including China's loan prime rate expected to remain unchanged at 3.1% for the one-year and 3.6% for the five-year rates.

▪ Oil prices saw a slight increase amid escalating conflicts, though concerns about weak fuel demand in China and forecasts of a global oil surplus limited the market's gains.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and/or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.