POST-MARKET SUMMARY 18 July 2023

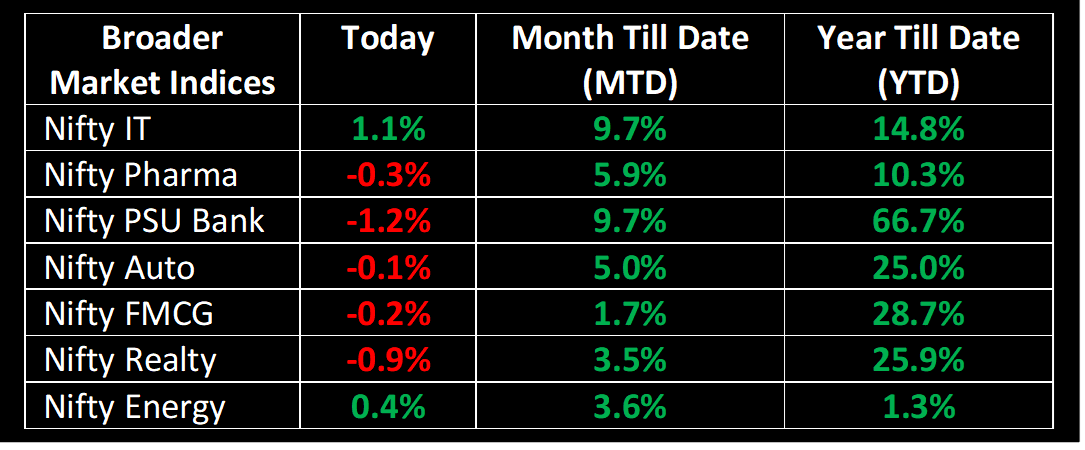

On July 18, the Nifty extended its upward trend for the fourth successive session, surpassing the 19,800 milestone for the first time. This remarkable rally was primarily supported by IT stocks and heavyweight Reliance Industries. Although global cues were a bit mixed, the market opened on a strong note, hitting new record levels. However, during the second half of the day, profit-booking activities resulted in the erasure of a significant portion of the gains made intraday.

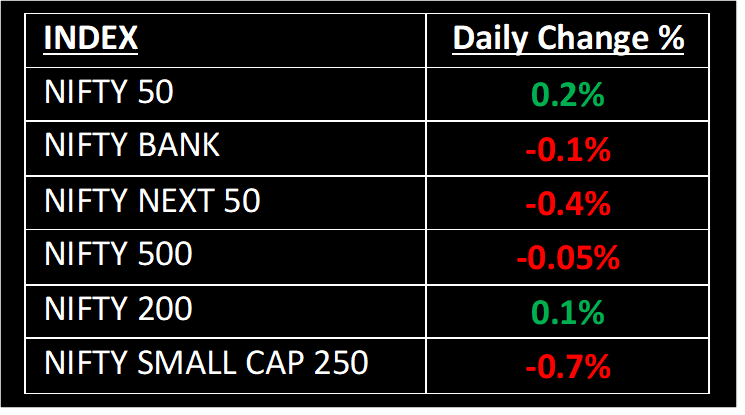

NIFTY: The index opened 76 points higher at 19,787 and made a high of 19,819 before closing at 19,749. Although the Nifty has formed a bearish candlestick pattern on the daily chart, it has continued to make higher highs and higher lows formation for four days in a row. Its immediate resistance level is now placed at 19,900 while immediate support is at 19,500.

BANK NIFTY: The index opened 305 points higher at 45,754 and closed at 45,410. Bank Nifty continued to make higher highs and higher lows formation for yet another session. Its immediate resistance level is now placed at 46,000 while support is at 45,000.

Stocks in Spotlight

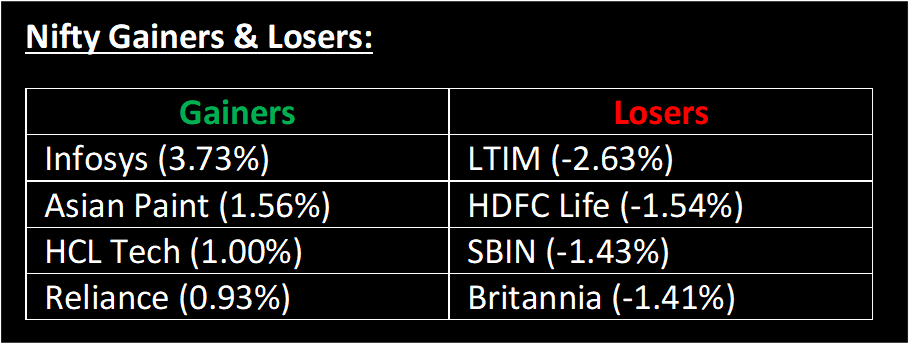

▪ Infosys Ltd: Stock surged nearly 4% after the company said that it had signed a multi-year agreement with one of its strategic clients to provide AI and automation-related services.

▪ One 97 Communications Paytm Ltd: Stock slipped 2.5% after SoftBank offloaded a 2% additional stake in the company.

▪ LTIMindtree Ltd: Stock fell nearly 3% after the company reported lower-than-expected earnings for the June quarter and a cautious growth outlook from the management dented investor sentiment.

Global News

▪ Oil prices rose slightly on Tuesday as investors weighed a possible tightening of US crude supplies against weaker-than-expected Chinese economic growth.

▪ The dollar drifted near a 15-month low against its major peers, as investors awaited fresh catalysts to gauge for downside in the wake of last week’s cooler-than-expected US inflation.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and / or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.