POST-MARKET SUMMARY 18 December 2023

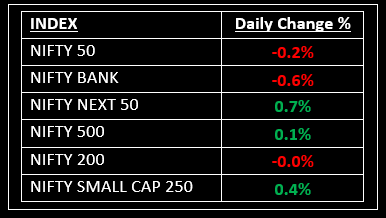

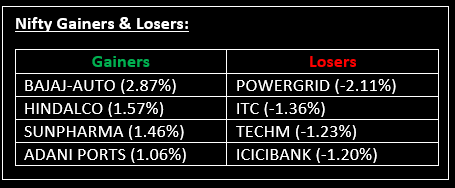

On December 18, the equity indices closed marginally lower after a volatile session, with Nifty hovering around 21,400. However, in the latter half, bears seized control, pushing the indices into the red. Top Gainer: BAJAJ-AUTO | Top Loser: POWERGRID

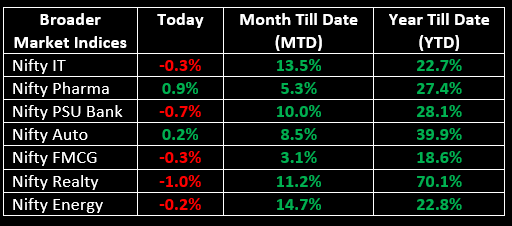

On December 18, the equity indices closed marginally lower after a volatile session, with Nifty hovering around 21,400. Starting the day on a negative note amidst mixed global cues, domestic indices staged a recovery in the initial hours, maintaining a flat trajectory for most of the first half. However, in the latter half, bears seized control, pushing the indices into the red. Noteworthy sector movements included a 1% gain in the Pharma index, a 0.7% rise in the Capital Goods index, a 1% dip in the Realty index, and a 0.5% decline in the Bank index.

NIFTY: The index opened 22 points lower at 21,434 and made a high of 21,482 before closing at 21,418. Nifty has formed a small-bodied bearish candlestick with upper and lower shadows on the daily chart. Its immediate resistance level is now placed at 21,490 while immediate support is at 21,360.

BANK NIFTY: The index opened 75 points lower at 48,068 and closed at 47,867. Bank Nifty has formed a bearish candlestick on the daily scale. Its immediate resistance level is now placed at 48,075 while support is at 47,620.

Stocks in Spotlight

▪ ITC: Stock fell 1% as British American Tobacco (BAT) considers reducing its 29.02% stake in the company.

▪ Siemens: Stock surged 6% and reached a lifetime high following the announcement that the company was exploring splitting its energy business into a separate entity.

▪ HFCL: Stock jumped 5% to hit a new 52-week high, marking a 20% increase in the last two trading sessions.

Global News

▪ Gold prices gained on Monday, helped by a softer dollar, while focus has now turned to key US inflation data seeking additional signals on the Federal Reserve’s interest rate path after its recent dovish tilt.

▪ Oil prices rose more than 2% as attacks by the Houthis on ships in the Red Sea raised concerns of oil supply disruptions, although ample supply and skepticism around Russia’s plan to cut exports in December limited gains.

▪ The yen retreated on Monday, but held near its recent highs, as the Bank of Japan kicked off a two-day meeting that could be crucial in determining the timing of the end of the central bank’s ultra-loose stance on interest rates.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and/or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.