POST-MARKET SUMMARY 17th September 2024

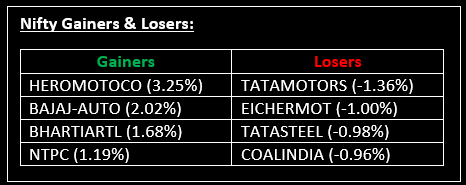

On September 17, the markets extended their gains for the second consecutive day, closing at record highs driven by telecom, auto, and construction stocks. Top Gainer: HEROMOTOCO | Top Loser: TATAMOTORS

On September 17, the markets extended their gains for the second consecutive day, closing at record highs driven by telecom, auto, and construction stocks. The rally comes ahead of the US Federal Reserve's monetary policy decision, where market participants anticipate a 25 bps interest rate cut. Read more: US FOMC Meet Begins Today: What To Expect?

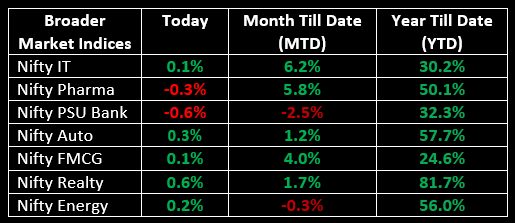

Sector-wise, realty and auto saw gains, while metals and pharma ended in the red.

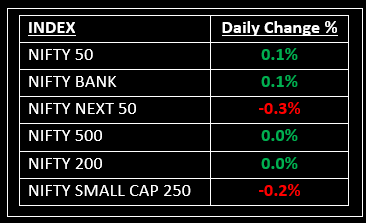

NIFTY: The index opened 33 points higher at 25,416 and made a high of 25,441 before closing at 25,418. Nifty has formed a Doji candlestick pattern on the daily chart. Its immediate resistance level is now placed at 25,500 while immediate support is at 25,350.

BANK NIFTY: The index opened 96 points higher at 52,249 and closed at 52,188. Bank Nifty has formed a bearish candlestick pattern on the daily timeframe. Its major resistance level is now placed at 52,350 while major support is at 51,900.

Stocks in Spotlight

▪ DCX Systems: Stock hit an upper circuit of 5% after the company informed the exchanges that its wholly-owned subsidiary was granted an industrial license.

▪ Geojit Financial: Stock slumped over 8% even as the company's Rights Issue Committee is scheduled to meet on September 19, 2024, to finalize key details regarding its upcoming rights issue.

▪ Reliance Infrastructure: Stock jumped over 9% after the company announced the schedule of a board meeting to discuss raising long-term funds.

Global News

▪ The pan-European Stoxx 600 index was 0.72% higher by 12:40 p.m. London time, with all major bourses and virtually all sectors in the green. Banks were up 1.37% while autos were 1.28% higher.

▪ Gold eased slightly on Tuesday after climbing to an all-time high in the previous session as dollar and treasury yields edged higher, while traders positioned themselves for a potential U.S. interest rate cut decision by the Federal Reserve this week.

▪ Oil prices edged lower on Tuesday, as fears of weaker demand in China weighed on market sentiment.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and/or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.