POST-MARKET SUMMARY 17th June 2025

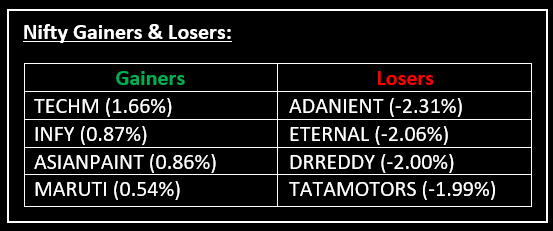

On June 17, Indian equities closed lower as ongoing tensions between Iran and Israel kept investor sentiment subdued. Top Gainer: TECHM | Top Loser: ADANIENT

On June 17, Indian equities closed lower as ongoing tensions between Iran and Israel kept investor sentiment subdued. The two nations continued their exchange of attacks for the fifth consecutive day, contributing to a risk-off mood in the markets. Investors also remained cautious, awaiting key developments, including the U.S. Federal Reserve's policy decision scheduled for Wednesday.

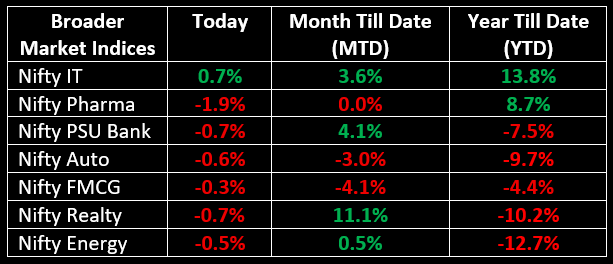

Among the sectors, Nifty IT bucked the trend, closing 0.7% higher, while other indices like Nifty PSU Bank, Nifty Oil & Gas, Nifty Auto and Nifty Realty saw losses ranging from 0.6% to 0.8%.

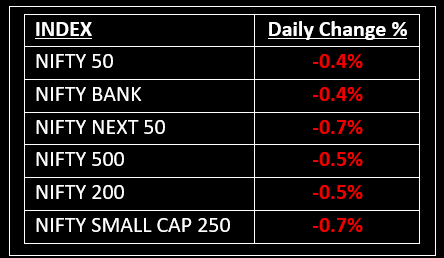

NIFTY: The index opened 31 points higher at 24,977 and made a high of 24,982 before closing at 24,853. Nifty has formed a bearish candle on the daily chart. Its immediate resistance level is now placed at 25,000 while its immediate support is at 24,700.

BANK NIFTY: The index opened 31 points higher at 55,975 and closed at 55,714. Bank Nifty has formed a bearish candle on the daily chart. Its immediate resistance level is now placed around 55,950 while immediate support is around 55,500.

Stocks in Spotlight

▪ Axiscades Technologies: Stock jumped 5% after the company signed a MoU with a European defence company to boost production of its cutting edge systems in India.

▪ Tanla Platforms: Stock closed 3% higher after the board approved a buyback proposal worth Rs 175 crore via a tender offer route at Rs 875 per share.

▪ Siemens: Stock advanced nearly 2% after a consortium led by the company secured a Rs 4,100 crore high speed rail project order from National High Speed Rail Corporation Ltd.

Global News

▪ Asian markets showed mixed results on Tuesday amid growing geopolitical tensions surrounding the Israel-Iran conflict. Japan's Nikkei 225, however, continued its upward momentum, rising 0.6% to close at a four-month high of 38,581.25.

▪ European stocks declined on Tuesday as concerns over the escalating Israel-Iran conflict deepened. US President Trump's call for the evacuation of Tehran and his early departure from the G7 summit fuelled speculation about increased US support for Israel's military actions.

▪ Gold surged towards $3,390 per ounce on Tuesday as rising Middle East tensions drove a spike in demand for safe-haven assets.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and/or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.