POST-MARKET SUMMARY 17th April 2025

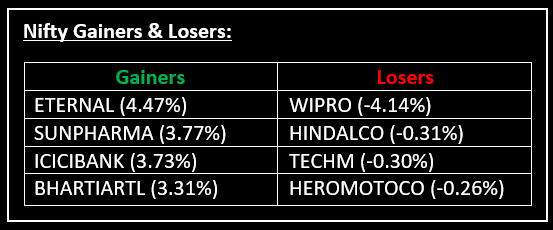

On April 17, the Indian equity market extended its gains for the fourth consecutive session, with Nifty crossing 23,800, led by buying across sectors, especially financials. Top Gainer: ETERNAL | Top Loser: WIPRO

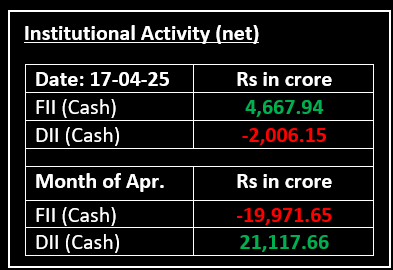

On April 17, the Indian equity market extended its gains for the fourth consecutive session, with Nifty crossing 23,800, led by buying across sectors, especially financials. The market also received a boost from a positive signal over trade deals between the US and Japan.

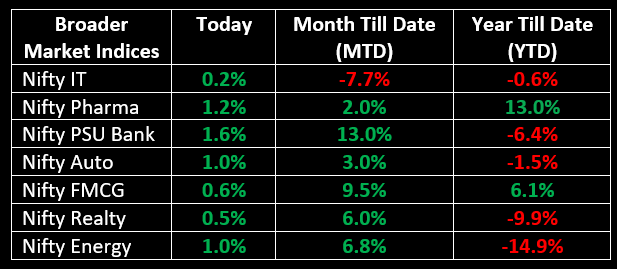

Amid mixed global cues, the Indian indices opened on a negative note and witnessed rangebound action in the first couple of hours. However, mid-session buying helped Nifty and Sensex to cross 23,850 and 78,600, respectively. All sectoral indices ended in the green, with telecom, PSU Bank, Oil & Gas, pharma, auto, energy, and private banks rising 1-2%.

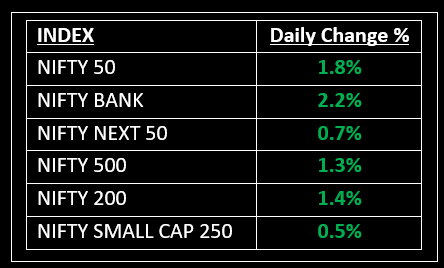

NIFTY: The index opened 36 points lower at 23,401 and made a high of 23,872 before closing at 23,851. Nifty has formed a strong bullish candle on the daily chart. Its immediate resistance level is now placed at 24,000 while its immediate support is at 23,700.

BANK NIFTY: The index opened 36 points higher at 53,153 and closed at 54,290. Bank Nifty has formed a strong bullish candle on the daily chart. Its immediate resistance level is now placed around 54,500 while immediate support is around 53,900.

Stocks in Spotlight

▪ Oil India: Stock gained almost 2% today, boosted by the award of nine new exploration blocks in the OALP Round IX auctions, covering a total area of over 51,000 square kilometers.

▪ Sonata Software: Stock plunged over 6% after the company warned that international revenue might fall short of Q4 forecasts.

▪ Suzlon Energy: Stock rose by 2% following the company’s receipt of a 100.8 MW order from Sunsure Energy.

Global News

▪ Asia-Pacific markets rose on Thursday, diverging from Wall Street, which declined sharply after U.S. Federal Reserve Chair Jerome Powell cautioned that ongoing trade tensions could challenge the central bank’s efforts to control inflation and spur growth.

▪ European markets pared losses but remained in negative territory on Thursday following the European Central Bank’s decision to cut interest rates.

▪ Oil prices climbed to their highest in two weeks on Thursday amid low liquidity ahead of the Easter holidays, after the United States imposed new sanctions to curb Iranian oil exports, raising supply concerns.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and/or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.