POST-MARKET SUMMARY 17 July 2023

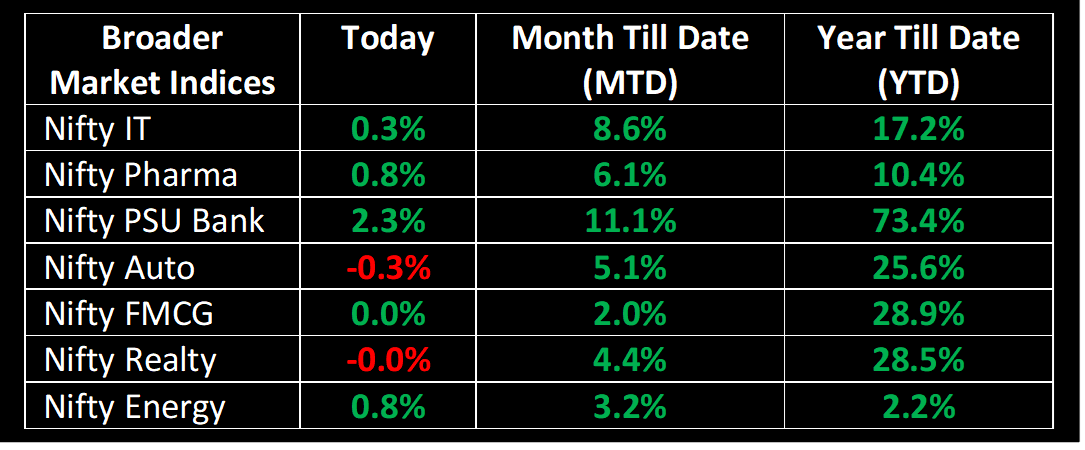

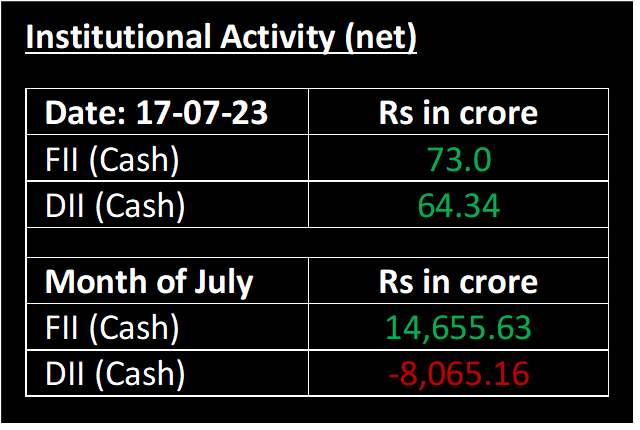

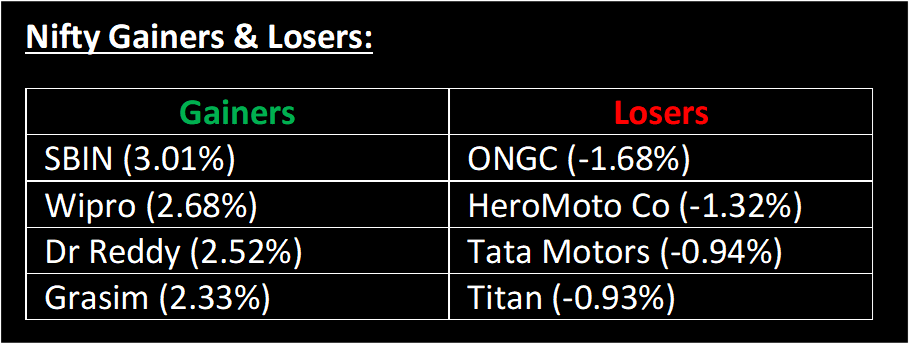

On July 17, the market witnessed another impressive rally, marking its third consecutive session of gains. Barring Auto, buying momentum was spread across various sectors, which helped Nifty comfortably close above the 19,700 mark. Despite receiving mixed cues from global markets, the market opened slightly higher and continued to rise throughout the day, achieving new record levels.

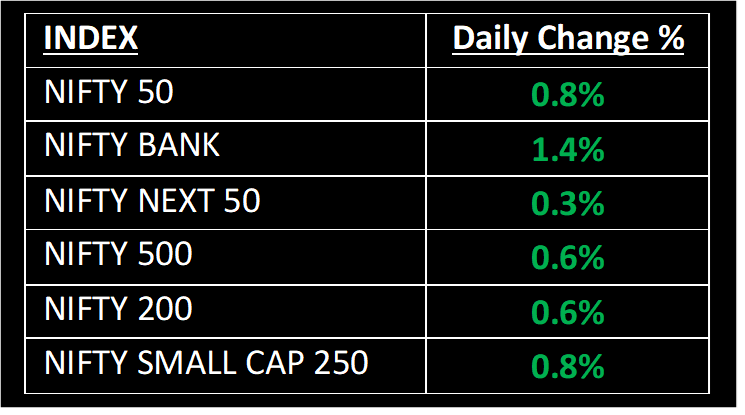

NIFTY: The index opened 48 points higher at 19,612 and made a high of 19,731 before closing at 19,711. Nifty has formed another bullish candlestick pattern on the daily chart, making higher highs and higher lows for the third consecutive session. Its immediate resistance level is now placed at 19,800 while immediate support is at 19,500.

BANK NIFTY: The index opened 132 points higher at 44,951 and closed at 45,449. Bank Nifty has formed a long bullish candlestick pattern on the daily chart, with above-average volumes. Its immediate resistance level is now placed at 45,800 while support is at 45,000.

Stocks in Spotlight

▪ Sterling and Wilson Renewable Energy Ltd: Stock surged 15.6% as the company secured two new domestic orders and is expected to improve EBITDA margins by FY25E.

▪ Dr Reddys Laboratories Ltd: Stock gained 2.7% after the company signed a pact for buying a 26% stake in special purpose vehicle O2 Renewable Energy IX Pvt Ltd.

▪ Avenue Supermarts Ltd: Stock slipped 3.26% after the company reported a 140 basis points fall in EBITDA margins for the June quarter.

Global News

▪ On Monday, crude oil fell over 1% as concerns arose over the demand for oil in the world's second-largest consumer, China, due to weaker-than-expected economic growth.

▪ Asia-Pacific markets witnessed a decline as investors analysed significant economic data released by China. The country's second-quarter GDP growth stood at 6.3%, which fell short of economists' expectations.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and / or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.