POST-MARKET SUMMARY 17 August 2023

Post-market report and news around trending stocks.

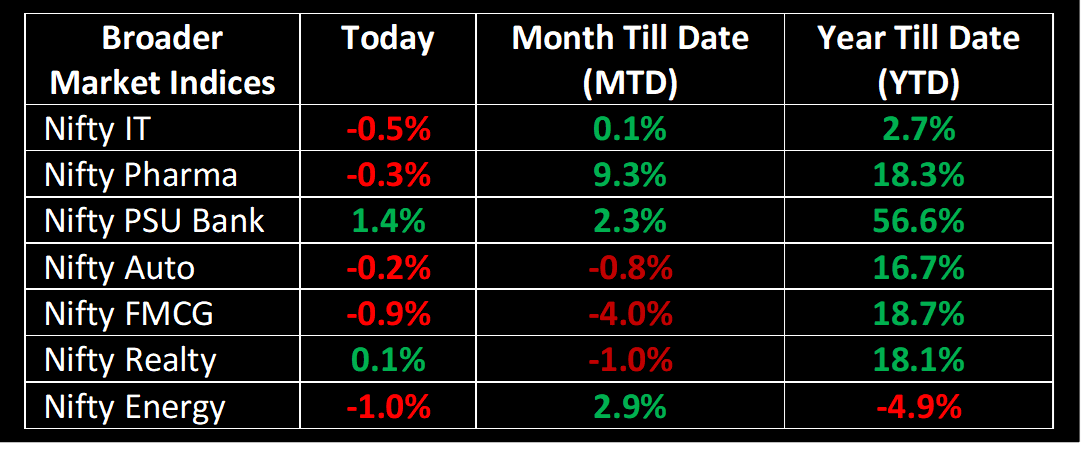

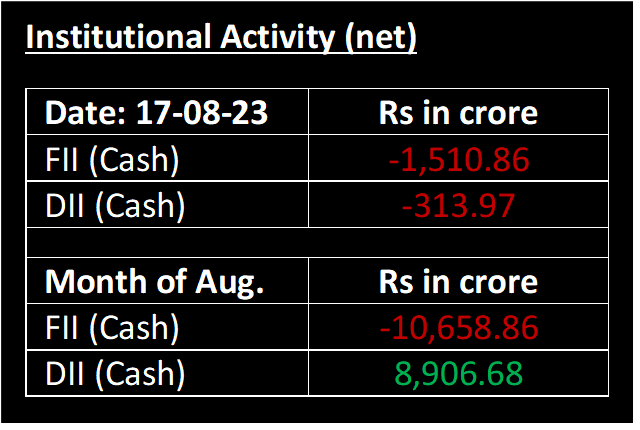

The Nifty ended the day below 19,400, driven by widespread selling across various sectors. The decline in today’s market was attributed to concerns about inflation and the influence of weak global indicators following the release of the US Federal Reserve meeting minutes. The suggestion of potential additional rate hikes in those minutes unnerved investors, contributing to their apprehension.

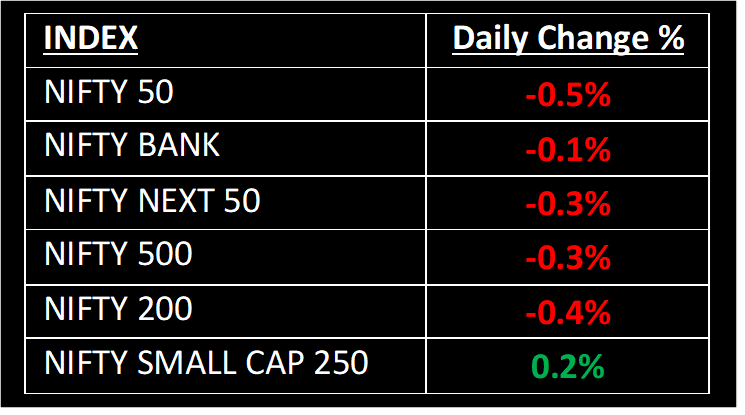

NIFTY: The index opened flat at 19,450 and made a high of 19,461 before closing at 19,365. Nifty has formed a bearish candlestick on the daily chart. Its immediate resistance level is now placed at 19,500 while immediate support is at 19,250.

BANK NIFTY: The index opened 49 points lower at 43,897 and closed at 43,891. Bank Nifty has formed a Doji candlestick on the daily chart, as the closing was near the opening levels, indicating that momentum is missing on both sides. Its immediate resistance level is now placed at 44,000 while support is at 43,700.

Stocks in Spotlight

▪ Bata India Ltd: Stock jumped 5.25% after a news report said that the shoe and leather goods maker has entered talks with Adidas for a tie-up for the Indian market.

▪ Rashtriya Chemicals and Fertilisers Ltd: Stock jumped 3% after it received the environmental clearance for setting up a nano-urea plant at its Trombay facility in Mumbai suburbs.

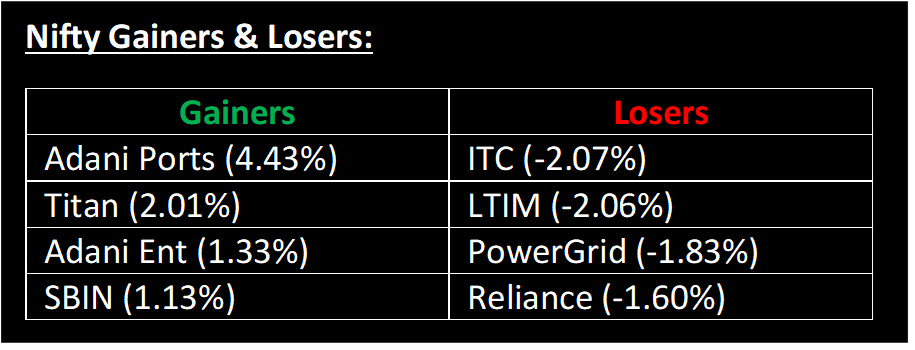

▪ Adani Power Ltd: Stock gained 2.38%, recovering the previous day’s loss, after it became known that GQG Partners was the buyer of 8.1% equity stake in the company.

Global News

▪ European Stoxx 600 index was down 0.2% by late morning, having trimmed earlier losses of around 0.6%. Industrials fell 1.7% while mining stocks added 0.8%. Corporate earnings continued to drive the brunt of individual share price moves.

▪ Gold prices touched 5-month lows on Thursday, as the US dollar and Treasury yields gained momentum after recent upbeat economic data added weight to expectations that the Federal Reserve would carry on with its policy tightening.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and / or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.