POST-MARKET SUMMARY 16th June 2025

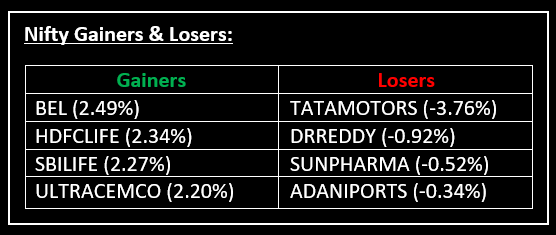

On June 16, Indian equity indices rebounded sharply after a sluggish start, supported by reports of Donald Trump mediating between Israel and Iran, which raised hopes for a ceasefire and improved market sentiment. Top Gainer: BEL | Top Loser: TATAMOTORS

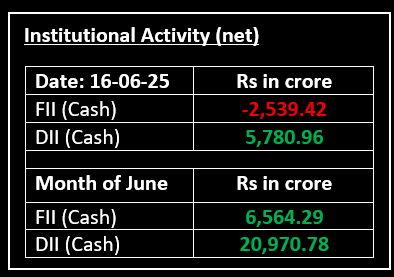

On June 16, Indian equity indices rebounded sharply after a sluggish start, supported by reports of Donald Trump mediating between Israel and Iran, which raised hopes for a ceasefire and improved market sentiment. India's positive macroeconomic outlook, driven by easing inflation and expectations of a favourable monsoon, continues to support the medium-to-long term prospects of the market.

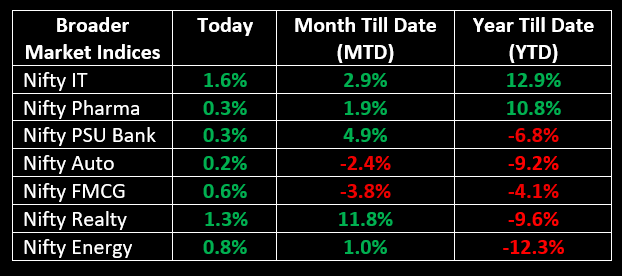

All sectoral indices ended in the green, with banks, FMCG, capital goods, consumer durables, IT, metals, realty, and oil & gas sectors seeing gains between 0.5% and 1%.

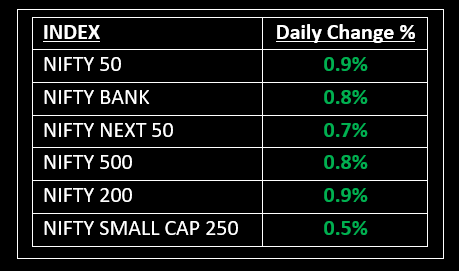

NIFTY: The index opened flat at 24,732 and made a high of 25,967 before closing at 24,946. Nifty has formed a strong bullish candle on the daily chart. Its immediate resistance level is now placed at 25,070 while immediate support is at 24,850.

BANK NIFTY: The index opened 27 points higher at 55,554 and closed at 55,944. Bank Nifty has formed a strong bullish candle on the daily chart. Its immediate resistance level is now placed around 56,200 while immediate support is around 55,750.

Stocks in Spotlight

▪ Sterlite Tech: Stock surged nearly 20% after announcing an expansion in its data centre portfolio to support AI infrastructure needs. The global data centre market is projected to reach $517 billion by 2030, growing at a 10.5% CAGR.

▪ Tata Motors: Stock fell over 3% after Jaguar Land Rover (JLR) flagged weak free cash flow expectations and macro risks in its investor presentation. JLR projected free cash flow to be "close to zero" in FY26, while targeting EBIT margins of 5-7%.

▪ HBL Engineering: Stock rose nearly 3% after the company secured a Rs 132.95 crore contract from South Central Railway for the installation of Kavach Systems.

Global News

▪ Asian equity markets saw a modest rebound on Monday, recovering from sharp losses last week caused by rising geopolitical friction between Israel and Iran.

▪ European shares were slightly higher on Monday, after rounding off last week with losses, as some corporate news-driven gains limited declines from increasing geopolitical tensions in the Middle East.

▪ Brent crude oil futures traded near $74 per barrel on Monday, pulling back after significant gains last week. The retreat occurred as investors reduced their risk-off positions, following signs that the Israel-Iran conflict may not escalate further, easing some of the market's earlier concerns.

▪ Gold dropped to approximately $3,420 per ounce on Monday, though it stayed close to the all-time highs hit in April.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and/or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.