POST-MARKET SUMMARY 16th December 2024

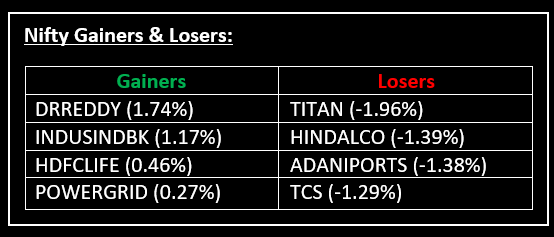

On December 16, the Indian benchmark indices erased some of the previous session's gains to close lower, with the Nifty slipping below 24,700. Top Gainer: DRREDDY | Top Loser: TITAN

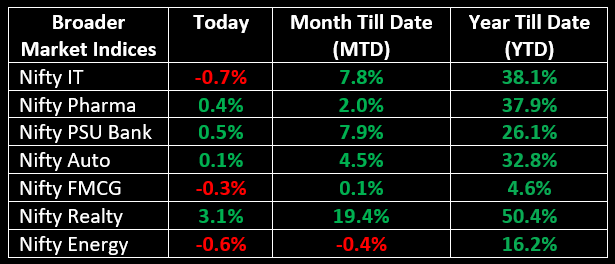

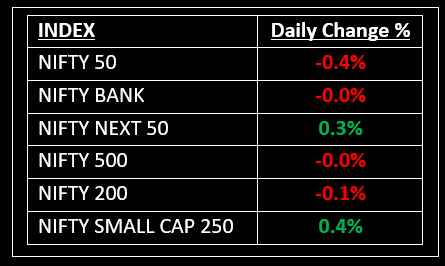

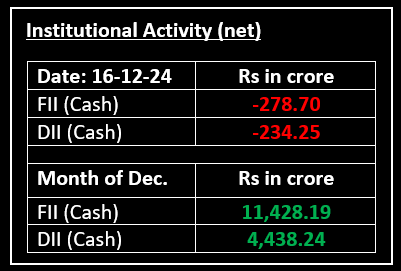

On December 16, the Indian benchmark indices erased some of the previous session's gains to close lower, with the Nifty slipping below 24,700. The decline came amid selling pressure in IT, metal, oil & gas, and FMCG stocks, though buying in realty, PSU banks, and media limited further losses. Despite a fall in WPI, the market opened flat with a negative bias and extended losses as the session progressed, with investors remaining cautious ahead of key rate announcements by the Fed and other central banks this week. Among sectors, the realty index rose 3%, the media index gained 1.5%, and the PSU bank index added 0.5%, while IT, metal, and oil & gas declined by 0.5–1%.

NIFTY: The index opened flat at 24,753 and made a high of 24,781 before closing at 24,668. Nifty has formed a a small bearish candlestick pattern on the daily chart. Its crucial resistance level is now placed at 24,860 while support is at 24,500.

BANK NIFTY: The index opened 81 points lower at 53,502 and closed at 53,581. Bank Nifty has formed a small bullish candle with upper and lower shadows on the daily chart. Its crucial resistance level is now placed at 53,900 while support is at 53,200.

Stocks in Spotlight

▪ PPAP Automotive Ltd: Stock surged 20% to hit an intraday high of Rs 259.95 after the company bagged fresh orders worth Rs 118 crore. Read more about it here.

▪ Premier Explosives Ltd: Stock hit the 10% upper circuit after the company entered into a MoU with Global Munition, to set up a joint venture to manufacture defence and aerospace products.

▪ GE Power India Ltd: Stock climbed 3.3% after the company received an extension of a Rs 18.27 crore purchase order, awarded by MP Power Generating Company.

Global News

▪ European markets were lower on Monday, as traders braced for the final week of central bank action this year and three French media businesses listed in Europe.

▪ Gold prices gained on Monday on a softer dollar, while investor caution set in ahead of the U.S. Federal Reserve’s policy meeting where the central bank is expected to deliver a third rate cut this year and provide hints regarding its 2025 outlook.

▪ The U.S. dollar hovered close to a three-week high versus other major currencies on Monday, ahead of a week of central bank meetings in which markets expect the Federal Reserve to cut interest rates but signal a measured pace of easing for 2025.The

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and/or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.