POST-MARKET SUMMARY 15th March 2024

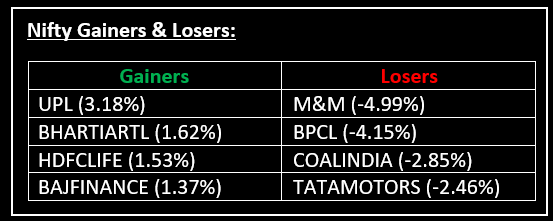

On 15th March, the Indian benchmarks Sensex and Nifty encountered their first weekly decline after four weeks of consecutive gains, posting a loss of around 2% for the week. Top Gainer: UPL | Top Loser: M&M

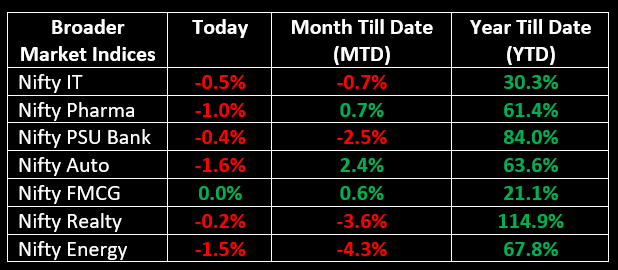

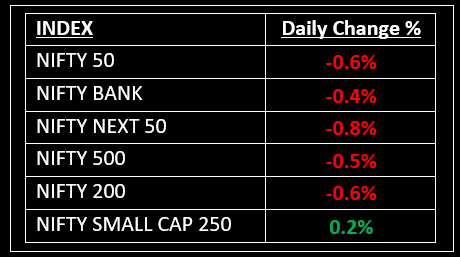

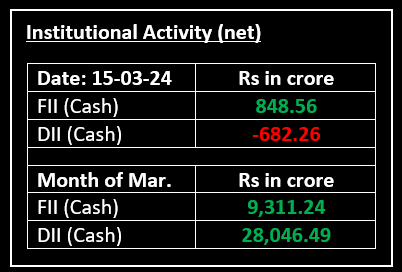

On 15th March, the Indian benchmarks Sensex and Nifty encountered their first weekly decline after four weeks of consecutive gains, posting a loss of around 2% for the week. This decline marked the most significant weekly downturn in 20 weeks. Continued broad-based selling and a downturn in mid and smallcap stocks persisted, raising concerns among investors amidst regulatory warnings. Moreover, weakness in global equities, influenced by disappointing US data, led to reduced expectations of a Federal Reserve interest rate cut, further dampening market sentiment.

NIFTY: The index opened 82 points lower at 22,064 and made a high of 22,120 before closing at 22,023. Nifty has formed a spinning top candlestick pattern on the daily chart. Its immediate resistance level is now placed at 22,100 while immediate support is at 21,900.

BANK NIFTY: The index opened 217 points lower at 46,572 and closed at 46,594. Bank Nifty has formed a Doji kind of candlestick pattern on the daily chart. Its immediate resistance level is now placed at 46,800 while support is at 46,300.

Stocks in Spotlight

▪ One97 Communications: Stock was locked in at 5% upper circuit at Rs 370.30 after the National Payments Corporation of India (NPCI) allowed it to function as a third-party application provider (TPAP) on Unified Payments Interface (UPI).

▪ RailTel: Stock surged by up to 7% following the announcement of a Rs 113.46 crore work order from Odisha Computer Application Centre.

▪ KPI Green Energy: Stock jumped 3% after securing a wind-solar power project from Gujarat Urja Vikas Nigam Limited.

Global News

▪ Gold prices edged lower on Friday, and were on track for their first weekly drop in four over concerns that the Federal Reserve might defer interest rate cuts beyond June after data showed a higher-than-expected rise in inflation.

▪ The dollar was on track for a weekly gain versus major currencies while the yen drifted lower on Friday, ahead of a flurry of highly-anticipated central bank meetings next week, including the U.S. Federal Reserve and Bank of Japan.

▪ Oil prices edged lower on Friday but were on track to gain nearly 4% for the week as sharp declines in U.S. crude and fuel inventories, drone strikes on Russian refineries and a rise in energy demand forecasts buoyed prices.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and/or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.