POST-MARKET SUMMARY 15th February 2024

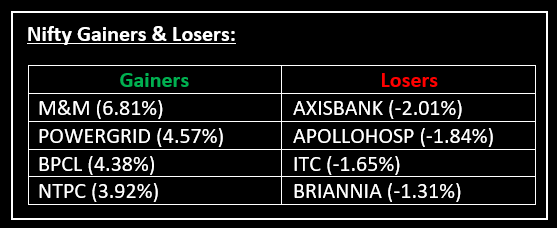

On February 15, amidst another volatile session, the market concluded with gains, extending its winning streak for the third consecutive session, with the Nifty crossing 21,900. Top Gainer: M&M | Top Loser: AXISBANK

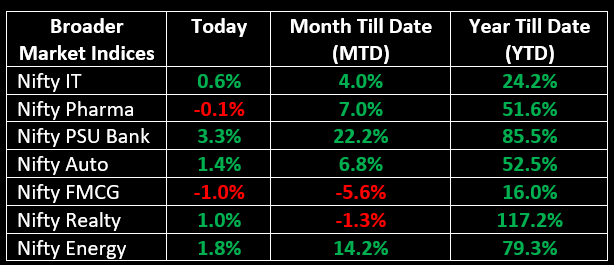

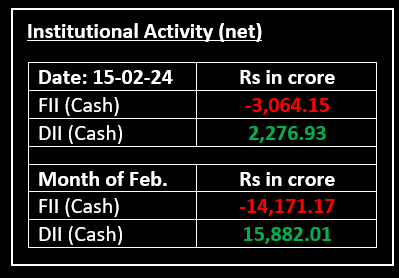

On February 15, amidst another volatile session, the market concluded with gains, extending its winning streak for the third consecutive session, with the Nifty crossing 21,900. Benefitting from positive global cues, Indian equity indices opened higher but erased some of the early gains to trade within a narrow range during the first half. However, they regained momentum in the latter half, closing near the day's peak levels. On the sectoral front, the FMCG index experienced a decline of 0.9%, while auto, PSU Bank, metal, realty, power, and oil & gas sectors saw gains ranging between 1% to 2%.

NIFTY: The index opened 66 points higher at 21,906 and made a high of 21,953 before closing at 21,910. Nifty has formed a Doji candlestick on the daily chart. Its immediate resistance level is now placed at 21,965 while immediate support is at 21,875.

BANK NIFTY: The index opened 119 points higher at 46,027 and closed at 46,218. Bank Nifty has formed a higher high and higher low formation for the third consecutive session, which is a positive sign. Its immediate resistance level is now placed at 46,380 while support is at 46,050.

Stocks in Spotlight

▪ Aster DM: Stock surged over 7% after the company said that it would split to create two separate entities, focused on India and GCC businesses.

▪ NMDC: Stock gained 4.7 % after the company reported stellar results for the December quarter.

▪ Sterlite Technologies: Stock rose 3.3% after the company announced its partnership with BAPS temple in Abu Dhabi for optical solutions.

Global News

▪ Asia-Pacific markets rebounded after mostly falling on Wednesday, while Japan entered a technical recession as its GDP contracted for a second straight quarter.

▪ UK’s Q4 GDP (gross domestic product) contracted 0.3% QoQ vs an estimated fall of 0.1%.

▪ The 10-year Treasury yield retreated after much weaker-than-expected retail sales.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and/or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.