POST-MARKET SUMMARY 15th April 2025

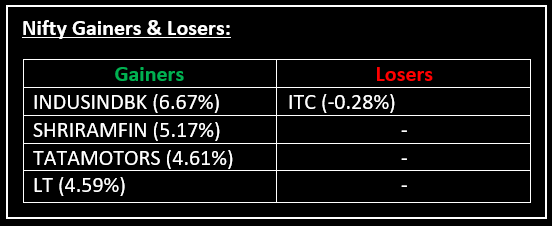

On April 15, benchmark indices continued their upward momentum for the second consecutive session, recovering all the losses incurred since the April 2 tariff announcement by US President Trump. Top Gainer: INDUSINDBK | Top Loser: ITC

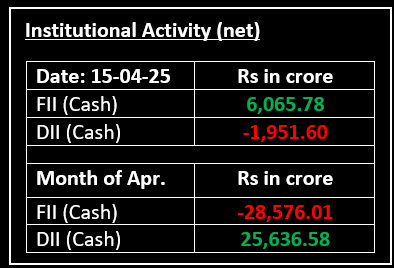

On April 15, benchmark indices continued their upward momentum for the second consecutive session, recovering all the losses incurred since the April 2 tariff announcement by US President Trump. The rally was fuelled by hopes of an exemption for car and auto parts, and later in the session, an announcement of above-average rainfall this year boosted sentiment.

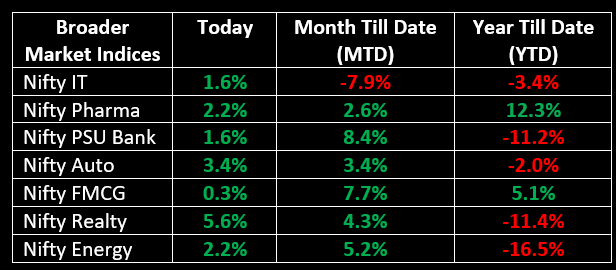

Consequently, FMCG stocks and agriculture-related sectors bounced back sharply from their lows. All sectoral indices closed in the green, with the realty index leading the charge, surging over 5% on strong buying support.

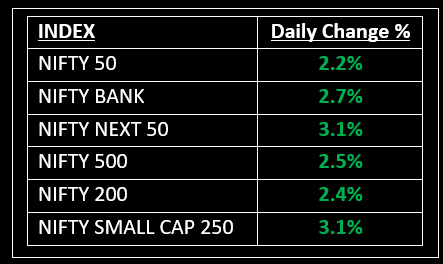

NIFTY: The index opened 540 points higher at 23,368 and made a high of 23,368 before closing at 23,328. Nifty has formed a hanging man candle on the daily chart. Its immediate resistance level is now placed at 23,450 while its immediate support is at 23,250.

BANK NIFTY: The index opened 1,297 points higher at 52,299 and closed at 52,379. Bank Nifty has formed a bullish candle on the daily chart. Its immediate resistance level is now placed around 52,700 while immediate support is around 52,000.

Stocks in Spotlight

▪ Apollo Micro Systems: Stock jumped nearly 5% after the company bagged orders worth Rs 7.52 crore from the Defence Research & Development Organisation (DRDO) and was declared the lowest bidder for orders worth Rs 11.48 crore from DRDO and a PSU.

▪ Mazagon Dock: Stock surged nearly 10% ahead of tomorrow's record date for the second interim dividend.

▪ Transrail Lighting: Stock continued its upward momentum, climbing over 8% after the company secured a significant order worth Rs 1,085 crore.

Global News

▪ Asian stock markets moved higher on April 15, 2025, influenced by developments in U.S. trade policies and regional economic factors.

▪ European markets also experienced a positive day, buoyed by easing U.S. trade tensions and expectations of monetary policy support from the European Central Bank (ECB).

▪ WTI crude oil futures slipped toward $61 per barrel, driven by signs of weakening demand and potential oversupply.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and/or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.