POST-MARKET SUMMARY 15 January 2024

On January 15, the Indian benchmark indices continued their winning streak for the fifth consecutive session, as both the Sensex and the Nifty achieved new milestones driven by widespread buying and positive earnings. Top Gainer: WIPRO | Top Loser: HDFCLIFE

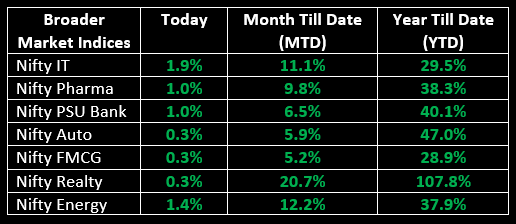

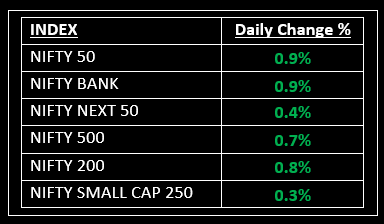

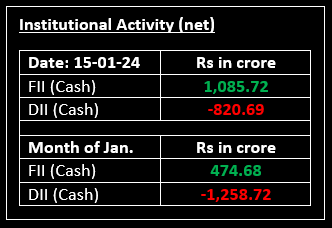

On January 15, the Indian benchmark indices continued their winning streak for the fifth consecutive session, as both the Sensex and the Nifty achieved new milestones driven by widespread buying and positive earnings. Despite mixed global cues, the indices opened on a positive note, reaching record highs of 73,402.16 and 22,115.55. The upswing was fuelled by increased investments in information technology, oil & gas, and banking sectors. In terms of sectoral performance, all indices, except for metals, closed in the green, with information technology, PSU banks, and oil & gas gaining 1% each.

NIFTY: The index opened 158 points higher at 22,053 and made a high of 22,115 before closing at 22,097. Nifty has formed a bullish candlestick pattern with a long lower shadow on the daily chart, indicating buying interest at the lower levels. Its immediate resistance level is now placed at 22,120 while immediate support is at 22,050.

BANK NIFTY: The index opened 181 points higher at 47,891 and closed at 48,158. Bank Nifty has formed a bullish candlestick pattern on the daily chart, with higher highs, higher lows formation for three days in a row, indicating trend reversal from down to up. Its immediate resistance level is now placed at 48,300 while support is at 48,000.

Stocks in Spotlight

▪ Just Dial: Stock gained 1.8% after the company’s net profit climbed 22% YoY to Rs 92 crore in Q3FY24.

▪ IRFC: Stock rallied 16% to hit a record high on the back of government’s focus on the sector, fresh capital infusion and expectations of strong December quarter.

▪ Avalon Technologies: Stock gained 2% after the company entered a partnership with Centre for Development of Advanced Computing (C-DAC) as part of the government's ‘RUDRA’ programme aimed at designing and manufacturing supercomputers in India.

Global News

▪ Gold prices edged up on Monday, holding above the $2,050 level on safe-haven appeal from elevated tensions in the Middle East and on renewed bets for an early rate cut by the US Federal Reserve.

▪ European markets slipped as Davos kicked off; German GDP down 0.3% in 2023.

▪ Mainland China’s market pared losses from earlier in the session after the country’s central bank left its medium-term policy loans rate unchanged, while Taiwan stocks rose after voters handed the ruling Democratic Progressive Party a third-straight presidential term.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and/or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.