POST-MARKET SUMMARY 15 December 2023

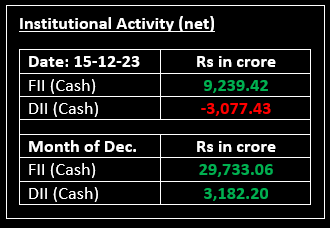

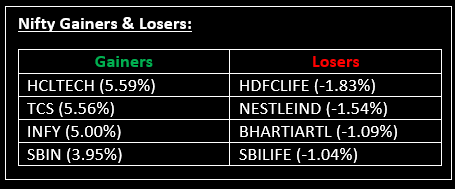

On December 15, Dalal Street marked new milestones as the bull run persisted, drawing buyers to the stock market amid positive sentiments fueled by the dovish stance adopted by the US Federal Reserve. Top Gainer: HCLTECH | Top Loser: HDFCLIFE

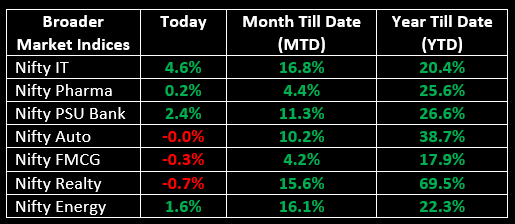

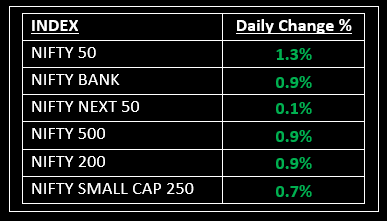

On December 15, Dalal Street marked new milestones as the bull run persisted, drawing buyers to the stock market amid positive sentiments fueled by the dovish stance adopted by the US Federal Reserve. Broader markets, however, underperformed compared to their larger counterparts. Nifty Smallcap saw an increase of 0.71%, and Nifty Midcap edged up by 0.11%. The Nifty 500 was up 0.9%.

NIFTY: The index opened 105 points higher at 21,287 and made a high of 21,492 before closing at 21,456. Nifty has formed a bullish candlestick on the daily chart. Its immediate resistance level is now placed at 21,500 while immediate support is at 21,330.

BANK NIFTY: The index opened 207 points higher at 47,939 and closed at 48,143. Bank Nifty has formed a bullish candlestick on the daily chart, with strong volumes. Its immediate resistance level is now placed at 48,300 while support is at 47,900.

Stocks in Spotlight

▪ JM Financial: Stock surged over 13% following a change in management and allotment of equity shares resulting from the exercise of stock options by eligible employees.

▪ LTI Mindtree: Stock gained over 3% after the IT services provider launched a delivery centre in Mexico City as it expands its presence in Latin America

▪ Suzlon Energy: Stock gained nearly 4% after the company bagged an order for the development of a 100.8 MW-wind power project from a global utility company.

Global News

▪ Gold prices held steady on Friday, but were on track for a weekly rise as the Federal Reserve shifted to a dovish stance and projected lower interest rates next year.

▪ The European blue-chip index closed Thursday’s trade up 0.9% after earlier hitting its highest point since January 2022.

▪ Oil prices rose on Friday, on track to notch their first weekly rise in two months after benefiting from a bullish forecast from the International Energy Agency (IEA) on oil demand for next year and a weaker dollar.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and/or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.