POST-MARKET SUMMARY 14th May 2025

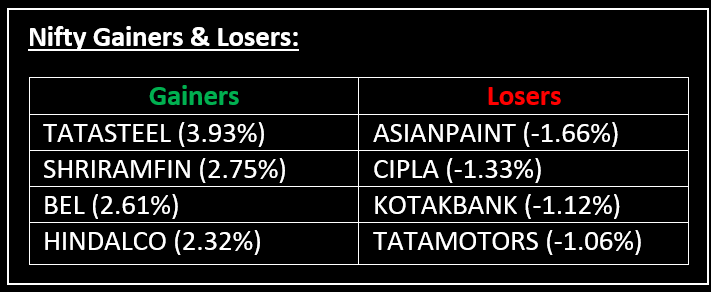

On May 14, Indian markets failed to build on their opening gains, ending marginally higher in a highly volatile session. Top Gainer: TATASTEEL | Top Loser: ASIANPAINT

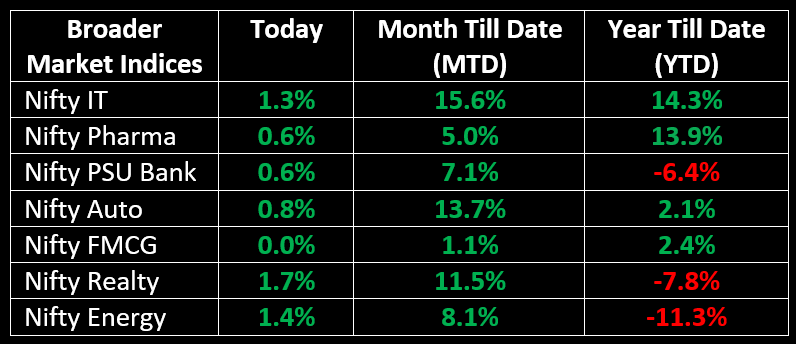

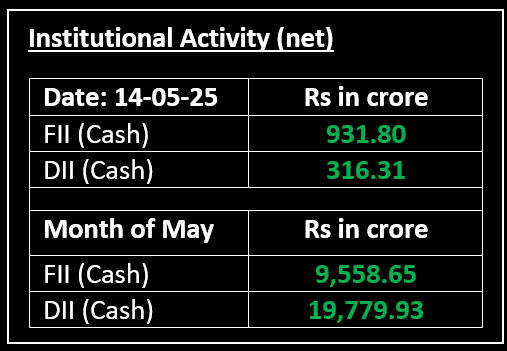

On May 14, Indian markets failed to build on their opening gains, ending marginally higher in a highly volatile session. While banking stocks faced pressure, sectors such as metal, realty, oil & gas, telecom, media and IT provided much-needed support, rising between 1% and 2.5%. India's retail inflation cooled to a near six-year low of 3.16% in April 2025, boosting investor sentiment.

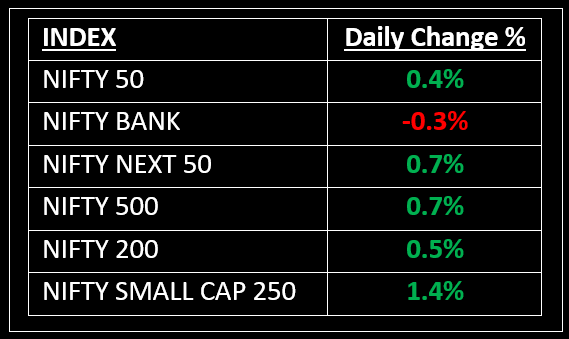

NIFTY: The index opened 35 points higher at 24,613 and made a high of 24,767 before closing at 24,666. Nifty has formed a small bullish candle on the daily chart. Its immediate resistance level is now placed at 24,770 while its immediate support is at 24,530.

BANK NIFTY: The index opened 68 points higher at 55,008 and closed at 54,801. Bank Nifty has formed a bearish candle on the daily chart. Its immediate resistance level is now placed around 55,000 while immediate support is around 54,450.

Stocks in Spotlight

▪ Garden Reach Shipbuilders & Engineers: Stock surged over 18% intraday following a strong quarterly performance. The company's net profit doubled while revenue from operations jumped by 62% year-on-year to Rs 1,642 crore in Q4FY25.

▪ Dalmia Bharat Sugar: Stock surged up to 9% as Q4FY25 results impressed, with net profit soaring 126% to Rs 206 crore, revenue jumping 36% to Rs 1,018 crore and a record-high EBITDA of Rs 215 crore.

▪ Raymond: Stock showed a nearly 64% drop in its share price as it went ex-date for the demerger of its real estate arm. Following the demerger, shareholders will receive 1 equity share of Raymond Realty for every share held in Raymond Ltd.

Global News

▪ Asian markets moved higher on Wednesday, fuelled by softer-than-expected U.S. consumer inflation, which eased concerns over the impact of U.S. tariff policies and boosted investor sentiment across the region.

▪ European markets struggled for direction on Wednesday as the optimism surrounding trade developments began to fade.

▪ Gold dipped to approximately $3,230 per ounce on Wednesday as the precious metal's safe-haven appeal has been undermined by easing trade tensions between the US and China.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and/or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.