POST-MARKET SUMMARY 14th March 2024

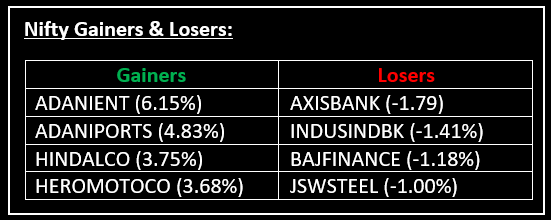

On March 14, the benchmark indices concluded positively, recovering from some of the losses incurred in the previous session, with the Nifty reaching approximately 22,150 amidst widespread buying across various sectors. Top Gainer: ADANIENT | Top Loser: JSWSTEEL

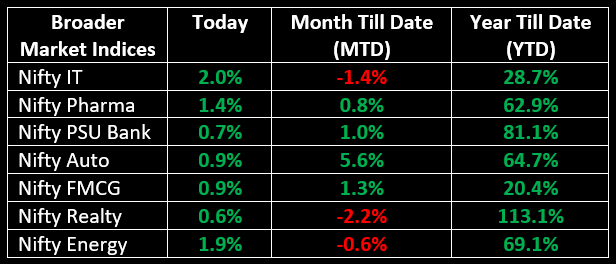

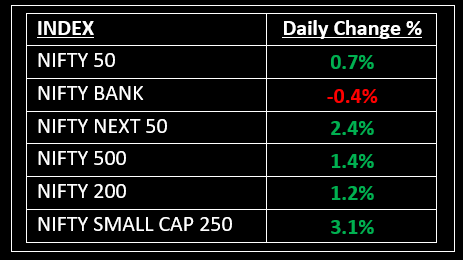

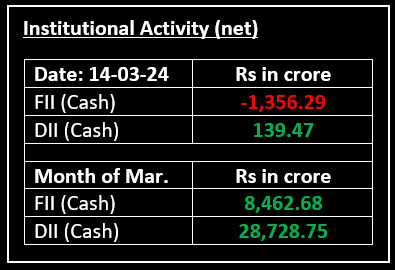

On March 14, the benchmark indices concluded positively, recovering from some of the losses incurred in the previous session, with the Nifty reaching approximately 22,150 amidst widespread buying across various sectors. Apart from banking, all other sectoral indices closed in positive territory, with telecom, power, and oil & gas registering gains of 3%, while auto, capital goods, FMCG, Information Technology, healthcare, and metal saw increases of 1-2%. The broader indices displayed stronger performance compared to the main indices, with the BSE Midcap index climbing by 2.2% and the Smallcap index advancing by 3%.

NIFTY: The index opened 15 points lower at 21,982 and made a high of 22,204 before closing at 22,146. Nifty has formed bullish candlestick pattern on the daily charts. Its immediate resistance level is now placed at 22,225 while immediate support is at 22,080.

BANK NIFTY: The index opened 156 points lower at 46,825 and closed at 46,789. Bank Nifty has formed a Doji kind of candlestick pattern on the daily charts. Its immediate resistance level is now placed at 47,200 while support is at 46,550.

Stocks in Spotlight

▪ SJVN Ltd: Stock jumped around 18% after SJVN Green Energy Limited received a Letter of Intent (LOI) from Gujarat Urja Vikas Nigam Limited (GUVNL) for a 500 MW solar project.

▪ Ashoka Buildcon: Stock surged 12% following its decision to acquire a 50% stake in GVR Ashoka Chennai ORR (CORR).

▪ Adani Green Energy: Stock surged nearly 10% following its subsidiary's agreement with Solar Energy Corporation of India (SECI) for 534-MW projects.

Global News

▪ The dollar inched higher on Thursday as investors waited for U.S. economic data later in the day, while bitcoin rose to a record high above $73,800.

▪ European markets slipped on Thursday afternoon, as investors assessed another key U.S. inflation reading for February.

▪ Asia-Pacific markets were mixed on Thursday after Wall Street’s tech-fueled rally dissipated, with investors focused on Japan’s spring wage negotiations and India’s wholesale inflation data.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and/or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.