POST-MARKET SUMMARY 14th July 2025

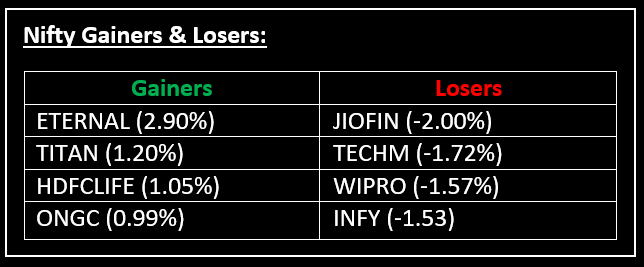

On July 14, benchmark indices closed lower for the fourth consecutive day, as tariff tensions weighed on market sentiment. Top Gainer: ETERNAL | Top Loser: JIOFIN

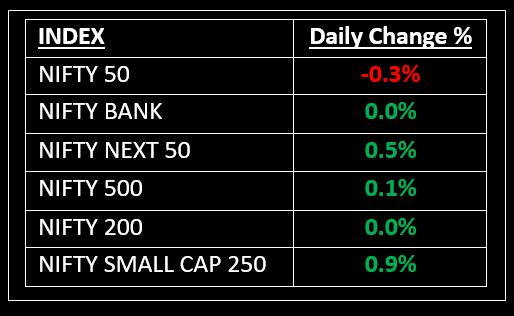

On July 14, benchmark indices closed lower for the fourth consecutive day, as tariff tensions weighed on market sentiment. However, the Nifty 50 managed to hold above the 25,000 mark and broader markets closed with gains with the BSE Midcap and Smallcap indices rising by 0.7% and 0.6%, respectively.

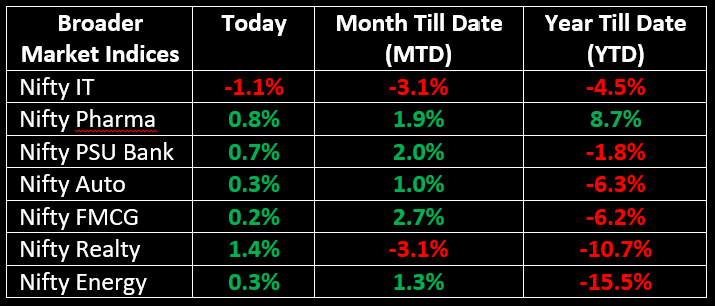

Among the sectors, the IT index shed 1% and the Financial Services index slipped 0.2%. Meanwhile, sectors such as PSU Bank, Pharma, Consumer Durables, Media and Realty saw gains between 0.7% and 1.4%.

In the primary market, Anthem Biosciences Ltd launched its IPO today, with the grey market premium (GMP) rising to 17.5% on the first day of bidding. A detailed IPO review is available here.

NIFTY: The index opened flat at 25,149 and made a high of 25,151 before closing at 25,082. Nifty has formed a bearish candle with a lower shadow on the daily chart. Its immediate resistance level is now placed at 25,150 while immediate support is at 25,000.

BANK NIFTY: The index opened 26 points higher at 56,780 and closed at 56,765. Bank Nifty has formed a Doji-like candlestick pattern on the daily chart. Its immediate resistance level is now placed around 57,000 while immediate support is around 56,600.

Stocks in Spotlight

▪ Ahluwalia Contracts: Stock surged 5.5% after the company secured a Rs 2,089 crore order from DLF for civil and structural works in Gurugram.

▪ Vishnu Prakash R Punglia: Stock jumped nearly 4% following the receipt of a Rs 78 crore order from Jaipur Development Authority for the construction of a Road Over Bridge (ROB).

▪ NCC: Stock climbed over 1.5% after the company bagged a major Rs 2,269 crore contract for Mumbai Metro Line 6 Systems from MMRDA.

Global News

▪ Gold surged to a three-week high, fueled by safe-haven demand following U.S. President Donald Trump’s threat of tariffs on the European Union and Mexico. Meanwhile, silver climbed to a near 14-year peak.

▪ World shares edged lower on Monday, with European stocks slipping as renewed threats in the U.S. tariff wars kept investors on edge.

▪ Oil prices rose, reaching their highest level in three weeks. This was driven by expectations of further U.S. sanctions on Russia, potentially impacting global supplies, along with increased oil imports by China, which provided additional support.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and/or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.