POST-MARKET SUMMARY 14 September 2023

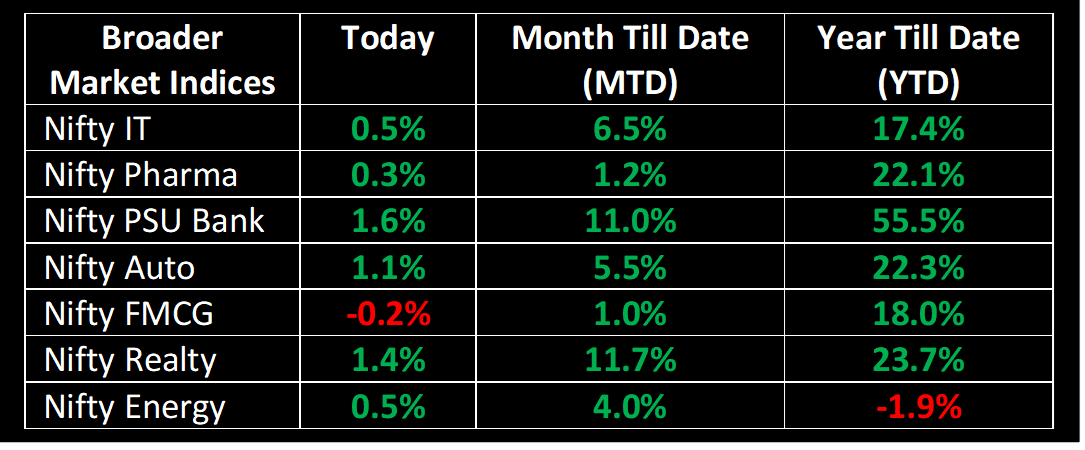

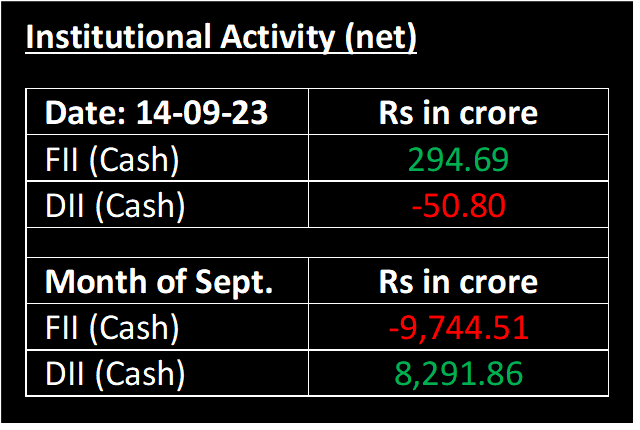

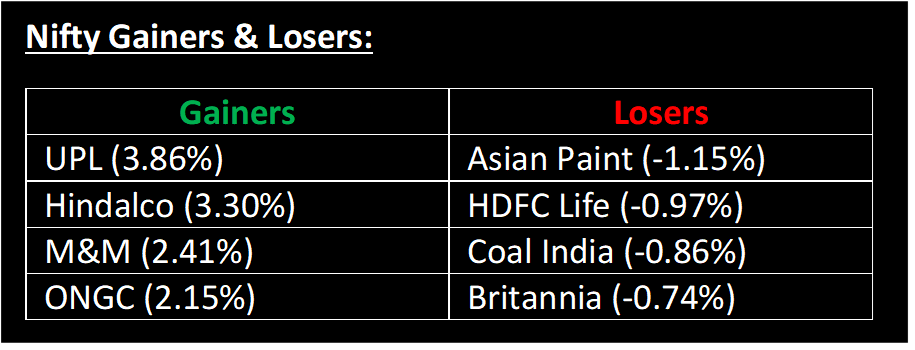

On the weekly expiry day, the markets experienced significant volatility but ultimately closed with slight gains. The Nifty is gradually climbing higher thanks to rotational buying in various sectors, even though global market signals are somewhat mixed.

On the weekly expiry day, the markets experienced significant volatility but ultimately closed with slight gains. Initially, there was an upward movement, but profit-booking in prominent stocks wiped out the overall gains and the market traded in a narrow range until the end of the day. The Nifty is gradually climbing higher thanks to rotational buying in various sectors, even though global market signals are somewhat mixed.

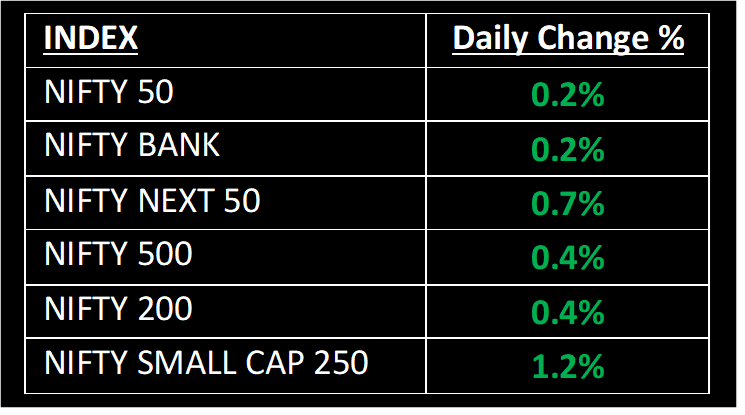

NIFTY: The index opened 57 points higher at 20,127 and made a high of 20,167 before closing at 20,103. Nifty has formed a Spinning Top kind of formation, indicating indecisiveness in the market after recent rally. Its immediate resistance level is now placed at 20,200 while immediate support is at 19,950.

BANK NIFTY: The index opened 104 points lower at 46,013 and closed at 46,000. Bank Nifty has formed a Doji kind of candlestick pattern on the daily timeframe after a rangebound session. Its immediate resistance level is now placed at 46,150 while support is at 45,600.

Stocks in Spotlight

▪ Kirloskar Ferrous Ltd: Stock traded 5.5% higher after the company said that its resolution plan for corporate debtor Oliver Engineering had been approved by the National Company Law Tribunal, New Delhi Bench.

▪ Bajaj Healthcare Ltd: Stock gained 1% after the company received an Establishment Inspection Report (EIR) from the USFDA for its plant in Vadodara, Gujarat.

▪ NBCC Ltd: Stock surged 7.7% after the company signed a quadripartite MoU with Ministry Of Steel, RINL & NLMC and receiving order worth Rs 180 crore.

Global News

▪ Pan-European Stoxx 600 index was slightly higher in early afternoon trade, moving from a 0.3% uptick to 0.5% following the ECB announcement.

▪ Asia-Pacific markets mostly rose even as US inflation rate in August came in hotter than expected at 3.7% compared to economists’ expectations of 3.6% in a Dow Jones survey.

▪ Gold held its ground on Thursday near three-week lows ahead of an interest rate decision by the ECB as well as US economic data that could provide clues on the monetary policy outlook.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and / or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.