POST-MARKET SUMMARY 14 July 2023

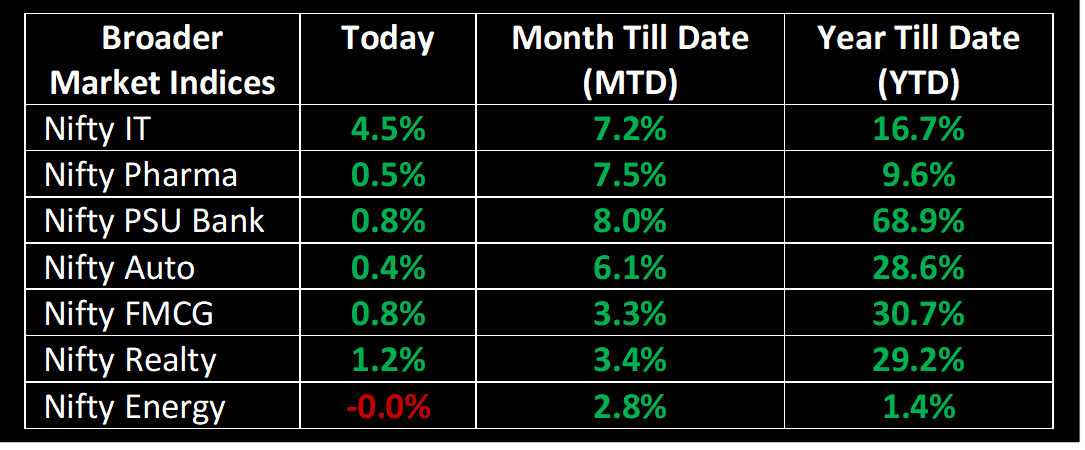

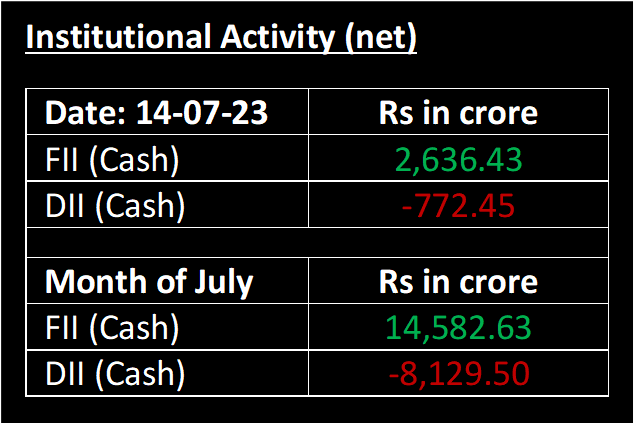

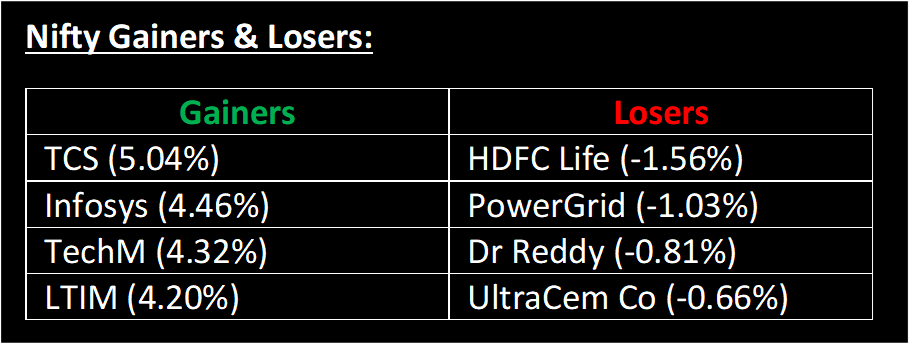

On July 14, the market maintained its upward trajectory, achieving new all-time highs, primarily driven by IT stocks. Influenced by positive international cues, the market opened on a positive note and remained relatively stable through most of the session. However, a surge in buying activities during the final hour propelled the benchmark indices to hit new record levels. There is a notable influx of robust foreign institutional investor (FII) inflows into the market, and investors are optimistic about the Federal Reserve potentially pausing its interest rate hikes later this month, given the moderation in US inflation.

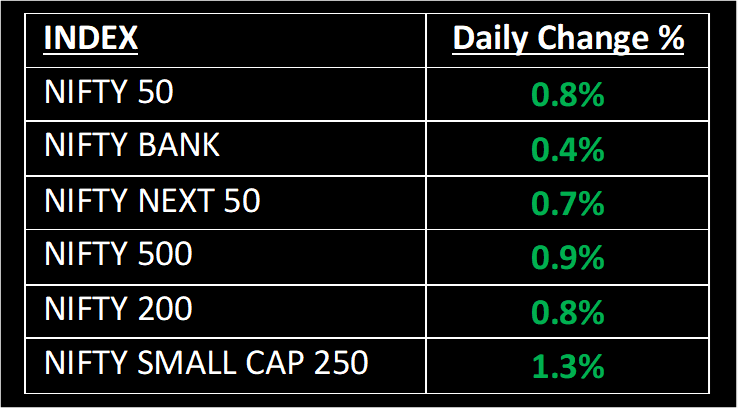

NIFTY: The index opened 80 points higher at 19,493 and made a high of 19,595 before closing at 19,564. Nifty has formed a bullish candlestick pattern on the daily chart, with above-average volumes. Its immediate resistance level is now placed at 19,600 while immediate support is at 19,200.

BANK NIFTY: The index opened 195 points higher at 44,860 and closed at 44,819. Bank Nifty has formed a Hammer candlestick pattern on the daily chart after its recent downtrend, which is a bullish reversal pattern. Its immediate resistance level is now placed at 45,200 while support is at 44,500.

Stocks in Spotlight

▪ Angel One Ltd: Company reported a 21.6% year-on-year growth in consolidated net profit at Rs 220.8 crore for the June quarter.

▪ Patanjali Foods Ltd: Stock hit 5% upper circuit after its promoter, Patanjali Ayurveda, proposed to sell 2.53 crore equity shares or 7% stake in the company.

▪ Gland Pharma Ltd: Stock rose 2.8% despite the US FDA issuing one observation for its Hyderabad facility.

Global News

▪ On Friday, gold experienced a slight decline following five consecutive sessions of gains, driven by increasing speculation of a potential halt in US interest rate hikes. This positive sentiment propelled bullion towards its most substantial weekly increase since April.

▪ Asia-Pacific markets surged in response to the release of inflation data from the US, which revealed a milder-than-anticipated increase. This development fostered optimism among investors that inflation might decrease without negatively impacting the labor market.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and / or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.