POST-MARKET SUMMARY 13th March 2025

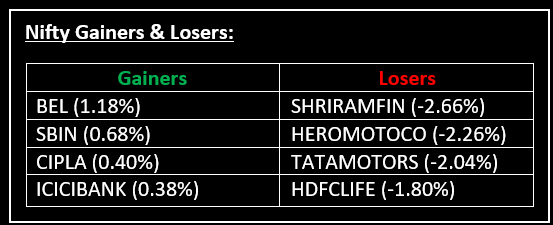

In a volatile session on March 13, benchmark indices ended lower, with Nifty slipping below 22,400 despite positive cues from industrial production and retail inflation data, closing the week nearly 1% lower. Top Gainer: BEL | Top Loser: SHRIRAMFIN

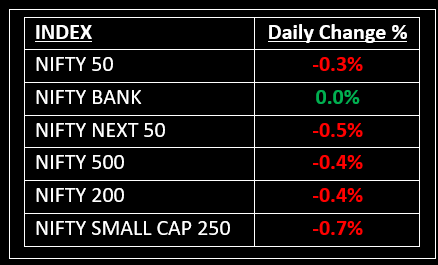

In a volatile session on March 13, benchmark indices ended lower, with Nifty slipping below 22,400 despite positive cues from industrial production and retail inflation data, closing the week nearly 1% lower.

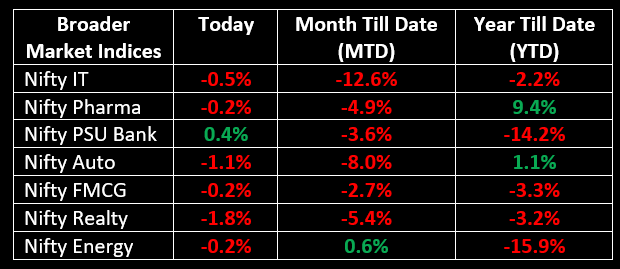

On the sectoral front, auto, IT, metal, media, and realty declined 0.5-1% each, while the PSU Bank index gained 0.5%.

NIFTY: The index opened 71 points higher at 22,541 and made a high of 22,558 before closing at 22,397. Nifty has formed a bearish candle on the daily chart. Its immediate resistance level is now placed at 22,500 while its major support is at 22,300.

BANK NIFTY: The index opened 163 points higher at 48,219 and closed at 48,060. Bank Nifty has formed a bearish candle with an upper shadow on the daily chart. Its major resistance level is now placed around 48,350 while immediate support is around 47,850.

Stocks in Spotlight

▪ InfoBeans Technologies: Stock jumped over 3% following a partnership with a leading Canadian standards organisation to implement AI-driven solutions.

▪ MTNL: Stock surged 16% after the Minister of State for Communications informed the Lok Sabha on March 12 that BSNL and MTNL earned Rs 12,984.86 crore from the monetisation of assets since 2019.

▪ Coromandel International: Stock rose 2.5% after signing agreements to acquire majority stake (53%) in NACL Industries for Rs 820 crore.

Global News

▪ Asian markets reversed initial gains and declined on Thursday as concerns over the economic impact of U.S. President Donald Trump’s trade policies outweighed optimism from cooler U.S. inflation data.

▪ European markets were mixed early Thursday afternoon as further threats from U.S. President Donald Trump pressured global trading relationships.

▪ Oil prices slipped on Thursday after surging in the previous session due to a larger-than-expected draw in U.S. gasoline stocks, as markets weighed macroeconomic concerns and demand-versus-supply expectations.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and/or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.