POST-MARKET SUMMARY 13th January 2025

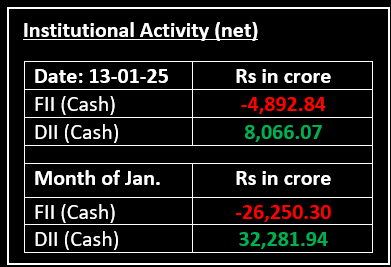

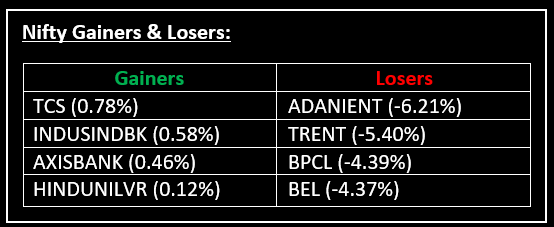

On January 13, Indian benchmark indices declined for the fourth consecutive session, pressured by broad-based selling, rising crude oil prices to a 3-month high, and weak global cues as investors lowered their expectations for a US rate cut in 2025. Top Gainer: TCS | Top Loser: ADANIENT

On January 13, Indian benchmark indices declined for the fourth consecutive session, pressured by broad-based selling, rising crude oil prices to a 3-month high, and weak global cues as investors lowered their expectations for a US rate cut in 2025.

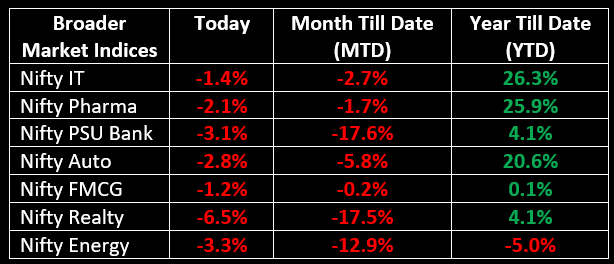

Sectorally, all indices closed in the red, with the realty index falling 6.7% and oil & gas, power, PSU, metal, and media sectors declining by 3-4%.

Meanwhile, in the primary market, the grey market premium (GMP) for Laxmi Dental’s IPO climbed to 28%. Get exclusive insights on the IPO here.

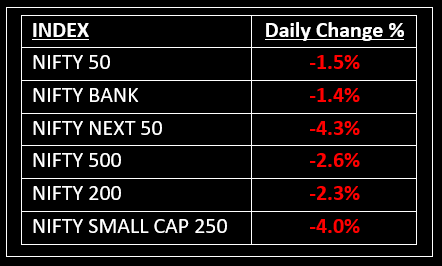

NIFTY: The index opened 236 points lower at 23,195 and made a high of 23,340 before closing at 23,085. Nifty has formed a bearish candlestick pattern on the daily chart. Its immediate resistance level is now placed at 23,200 while its immediate support is at 23,000.

BANK NIFTY: The index opened 470 points lower at 48,264 and closed at 48,041. Bank Nifty has formed a bearish candlestick pattern on the daily chart. Its immediate resistance level is now placed around 48,250 while immediate support is around 47,850.

Stocks in Spotlight

▪ PCBL: Stock fell 10% as investors reacted to the company's disappointing Q3 earnings, which saw a 37% decline in net profit to Rs 93 crore, primarily due to a spike in operating costs.

▪ Biocon: Stock jumped over 4% intraday after the US FDA cleared Biocon Biologics' insulin facility in Malaysia, resolving a major regulatory hurdle. The regulator classified the facility as "Voluntary Action Indicated" (VAI), allowing the company to proceed with product filings from the site.

▪ Adani Wilmar: Stock fell 10% after promoter Adani Commodities opted to exercise the oversubscription option in its two-day offer-for-sale (OFS).

Global News

▪ Stocks and bonds slid in Asia following Friday’s stronger-than-expected US jobs data. The MSCI Asia Pacific index dropped as much as 1%, with benchmarks in Hong Kong, Taiwan and South Korea leading the declines among major regional markets.

▪ European markets were lower on Monday amid persisting jitters over the global economy and a surging U.S. dollar.

▪ WTI crude oil futures surged over 2% to above $78/ barrel on Monday, the highest level in more than four months, as new US sanctions on Russia’s energy sector raised concerns about supply disruptions.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and/or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.