POST-MARKET SUMMARY 13th February 2025

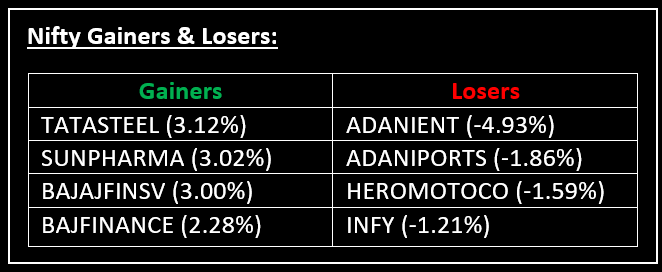

On February 13, India's benchmark indices ended lower, slipping into negative territory, though selling pressure has gradually eased over the past two sessions. Top Gainer: TATASTEEL | Top Loser: ADANIENT

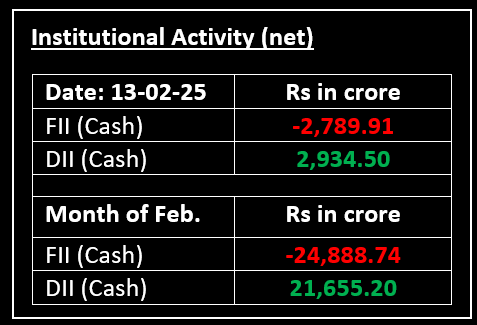

On February 13, India's benchmark indices ended lower, slipping into negative territory, though selling pressure has gradually eased over the past two sessions. After a flat-to-positive start, markets gained momentum as investor sentiment improved, supported by cooling retail inflation at a five-month low and a decline in crude prices amid progress in resolving the Ukraine-Russia conflict. However, profit-booking in the second half led to a flat close.

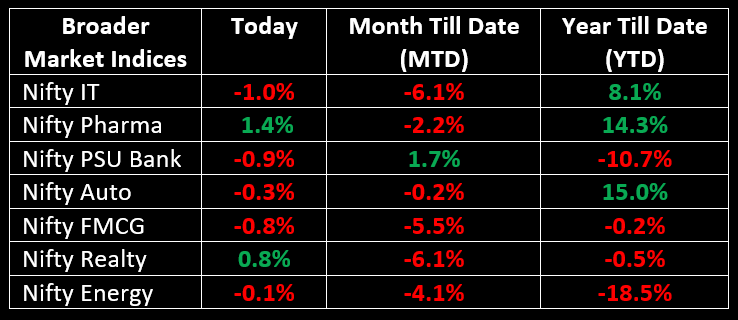

Sectorally, Media, Metal, Pharma, and Realty gained 0.5-1%, while Auto, FMCG, IT, Consumer Durables, and PSU Banks declined 0.3-1%.

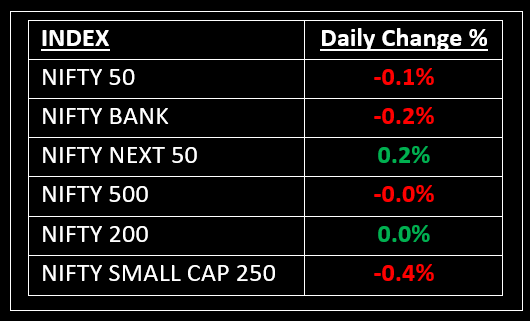

NIFTY: The index opened flat at 23,055 and made a high of 23,235 before closing at 23,031. Nifty has formed a small-bodied bearish candlestick pattern on the daily chart. Its immediate resistance level is now placed at 23,100 while its immediate support is at 22,950.

BANK NIFTY: The index opened flat at 49,469 and closed at 49,359. Bank Nifty has formed a small bearish candlestick pattern with a long upper shadow on the daily chart. Its immediate resistance level is now placed around 49,700 while immediate support is around 49,000.

Stocks in Spotlight

▪ Godrej Industries Ltd: Stock surged nearly 10% intraday after the company reported strong December quarter results. Net profit soared 76.9% year-on-year to ₹188.2 crore, while revenue from operations rose 34.4% to ₹4,824.8 crore.

▪ Natco Pharma: Stock plummeted 20% after the company reported disappointing Q3 earnings. Net profit declined 38% year-on-year to ₹132.4 crore while revenue dropped over 37% to ₹474.8 crore.

▪ Balaji Amines: Stock fell 5% intraday after the company reported a sharp decline in operational performance for Q3. EBITDA margin contracted to 14.3% from 19.1% a year ago, affected by lower volumes and capital expenditure projects.

Global News

▪ European stock markets traded higher on Thursday, supported by strong earnings reports, economic data, and renewed optimism over a potential resolution to the Russia-Ukraine conflict. The British economy expanded by 0.9% in 2024, up from 0.4% in 2023, primarily driven by a 1.3% growth in the services sector, which had risen 0.4% the previous year.

▪ Meanwhile, China’s central bank announced plans to adjust its monetary policy at an opportune time to support the economy, as external headwinds continue to mount.

▪ WTI crude oil futures dropped 1% to $70.5 per barrel, nearing a seven-week low, as optimism around Russia-Ukraine peace talks—reinforced by President Trump—fueled expectations of easing sanctions on Russian oil exports.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and/or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.