POST-MARKET SUMMARY 13th August 2025

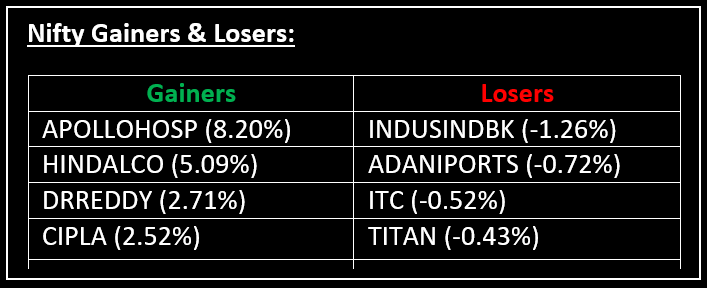

On 13, the Indian market ended higher, recovering from previous session losses, with Nifty closing above 24,600, driven by broad-based sectoral buying. Top Gainer: APOLLOHOSP | Top Loser: INDUSINDBK

On 13, the Indian market ended higher, recovering from previous session losses, with Nifty closing above 24,600, driven by broad-based sectoral buying. The easing of the US July Consumer Price Index (CPI) to 2.7% and India's retail inflation declining to 1.6%—it’s lowest in eight years—boosted sentiment, fuelling optimism for rate cuts by the respective central banks in their upcoming monetary policy meetings.

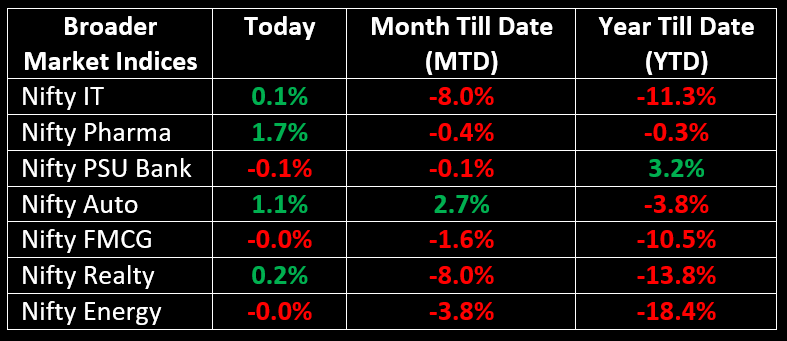

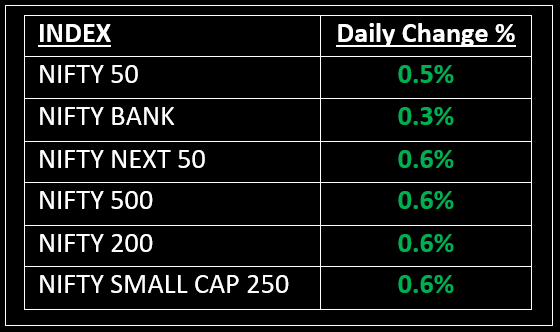

Among the broader indices, the BSE Midcap and Smallcap indices gained 0.6% each. On the sectoral front, all indices, except for PSU Bank, FMCG and Oil & Gas, ended in the green, with Auto, Metal and Pharma sectors rising by 1%–1.7%

NIFTY: The index opened 98 points higher at 24,586 and made a high of 24,664 before closing at 24,619. Nifty has formed a bullish candle with upper and lower shadows on the daily chart. Its immediate resistance level is now placed at 24,700 while its immediate support is at 24,540.

BANK NIFTY: The index opened 296 points higher at 55,340 and closed at 55,181. Bank Nifty has formed a small bearish candle on the daily chart. Its immediate resistance level is now placed around 55,350 while immediate support is around 55,000.

Stocks in Spotlight

▪ Premier Explosives: Stock hit the 20% upper circuit limit after the defence and space product maker reported a 110% surge in Q1 net profit to Rs 15 crore, while revenue rose nearly 72% to Rs 142 crore.

▪ Apollo Hospitals: Stock surged 8% after the healthcare player reported a 42% year-on-year increase in consolidated net profit to Rs 433 crore, with revenue rising 15% to Rs 5,842 crore.

▪ NMDC Steel: Stock was locked at the 20% upper circuit after the company swung into profits in the June quarter, posting a net profit of Rs 26 crore compared to a net loss of Rs 547 crore in the same period last year.

Global News

▪ Global share markets edged higher on Wednesday as investors cheered mild inflation data, signs of resilience in major economies and expectations of a U.S. rate cut, which buoyed demand for riskier assets.

▪ Oil prices dipped slightly on Wednesday after the International Energy Agency reported that supply is overtaking demand this year, while investors awaited the upcoming meeting between U.S. President Donald Trump and Russian President Vladimir Putin on Friday.

▪ Gold prices rose on Wednesday, bolstered by expectations of a U.S. Federal Reserve interest rate cut in September following mild inflation data, while a weaker dollar increased demand.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and/or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.