POST-MARKET SUMMARY 13 October 2023

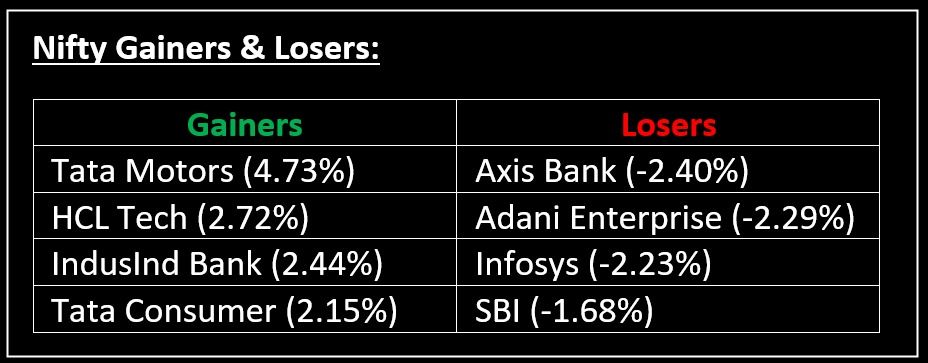

On October 13, the market experienced downward pressure as technology giants continued to decline due to concerns about future demand, while a decline in banking stocks further dampened market sentiment. Top Gainer: Tata Motors | Top Loser: Axis Bank

On October 13, the market experienced downward pressure as technology giants continued to decline due to concerns about future demand, while a decline in banking stocks further dampened market sentiment. The day began with a gap-down opening influenced by weak global indicators, partly due to slightly higher-than-expected US inflation. However, there was a brief recovery, which didn't last long as bearish sentiment returned.

NIFTY: The index opened 140 points lower at 19,654 and made a high of 19,805 before closing at 19,751. Nifty has formed a bullish candlestick pattern on the daily chart, with average volumes. Its immediate resistance level is now placed at 19,800 while immediate support is at 19,670.

BANK NIFTY: The index opened 277 points lower at 44,322 and closed at 44,287. Bank Nifty has formed a Doji kind of indecisive candlestick pattern on the daily scale. Its immediate resistance level is now placed at 44,560 while support is at 44,050.

Stocks in Spotlight

▪ HDFC AMC: Stock surged nearly 4% as analysts raised their earnings growth estimates for the company after the release of robust September quarter results.

▪ SJVN Ltd: Stock jumped over 3% after the company's subsidiary bagged a renewable power project worth Rs 600 crore in Rajasthan.

▪ IRCON: Stock jumped over 10% after the government granted 'Navratna' status to the PSU, allowing it more autonomy.

Global News

▪ Hong Kong stocks fell more than 2%, leading losses in the wider Asia-Pacific markets fall as investors digested China’s inflation and trade data for September.

▪ Oil prices on Friday rose more than 4% after the US tightened sanctions against Russian crude exports.

▪ Gold prices rose on Friday, set to mark their best week since mid-March as US bond yields lowered, increasing the appeal of US dollar-backed bullion as markets price in a chance that Fed’s rate increase cycle has come to an end.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and / or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.