POST-MARKET SUMMARY 13 November 2023

Following an hour of bullish activity during Muhurat Trading the day before, Indian stocks succumbed to selling pressure on November 13 amid global market fluctuations and a Moody's downgrade of the US credit rating outlook, contributing to sustained elevated yields.

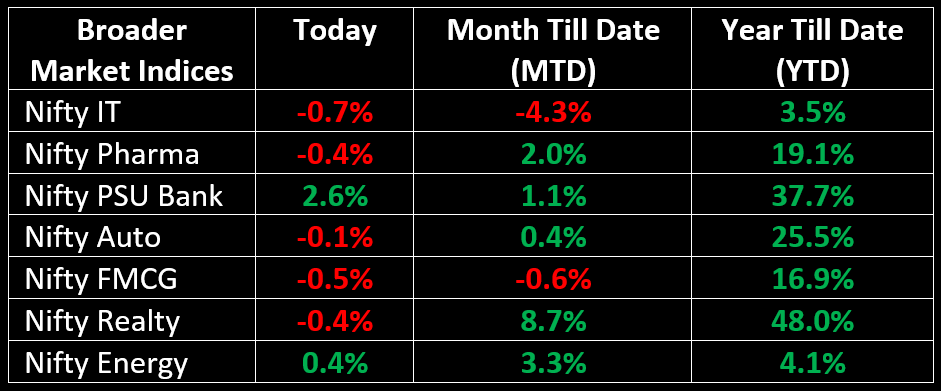

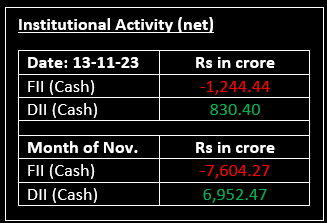

Following an hour of bullish activity during Muhurat Trading the day before, Indian stocks succumbed to selling pressure on November 13 amid global market fluctuations and a Moody's downgrade of the US credit rating outlook, contributing to sustained elevated yields. Despite this, the broader market maintained its outperformance, with notable buying observed in PSU banking stocks and metals, while other sectors grappled with supply pressures. The market will remain shut on November 14 for Diwali Balipratipada.

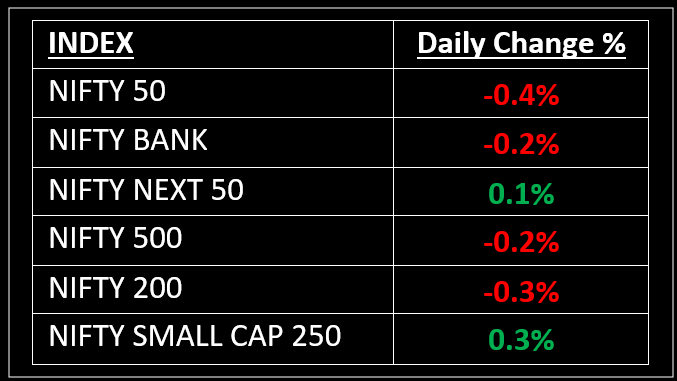

NIFTY: The index opened 39 points lower at 19,486 and made a high of 19,494 before closing at 19,443. Nifty has formed a bullish candlestick pattern with lower shadow on the daily chart. Its immediate resistance level is now placed at 19,480 while immediate support is at 19,400.

BANK NIFTY: The index opened 81 points lower at 43,915 and closed at 43,891. Bank Nifty has formed a bearish candle on the daily chart while managing to close above its crucial moving average (21-day EMA - 43,650). Its immediate resistance level is now placed at 44,050 while support is at 43,600.

Stocks in Spotlight

▪ BHEL: Stock jumped over 5% with strong trade volumes. Eight crore shares exchanged hands compared to the monthly average of two crore.

▪ BSE Ltd: Stock jumped 9% after the stock exchange’s net profit jumped 303% YoY to Rs 120 crore while revenue rose 46% to Rs 310 crore.

▪ Mrs Bectors Ltd: Stock rose over 6% after the company reported a consolidated net profit of Rs 37.28 crore for the September quarter of FY24, up 70% YoY.

Global News

▪ Pan-European Stoxx 600 index was up 0.7%, with travel and leisure stocks adding 1.7% to lead gains as almost all sectors and major bourses advanced.

▪ Most Asia-Pacific markets were mixed on Monday, as investors look to more economic data ahead of high-stakes talks between the US and China.

▪ US Treasury yields were little changed Monday, as investors considered the state of the economy and awaited key inflation data due out this week for indicators of monetary policy decisions ahead.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and/or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.