POST-MARKET SUMMARY 13 December 2023

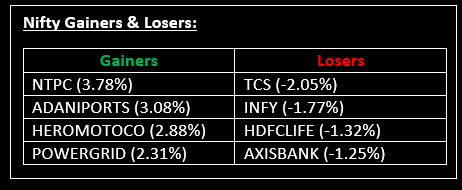

On December 13, in a highly volatile session, the Indian benchmark indices concluded with slight gains in anticipation of the FOMC meeting outcome later in the night. Top Gainer: NTPC | Top Loser: TCS

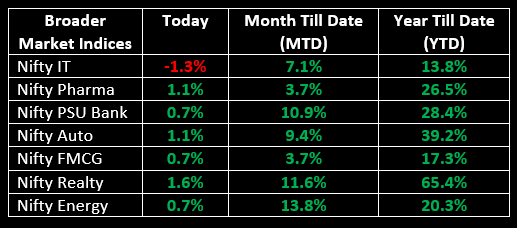

On December 13, in a highly volatile session, the Indian benchmark indices concluded with slight gains in anticipation of the FOMC meeting outcome later in the night. On the sectoral front, auto, power, pharma, capital goods, and realty witnessed a 1% increase each, while the information technology index saw a 1% decline. The BSE Midcap index surged 1% to achieve a new record high, and the BSE Small cap index registered a 0.7% increase.

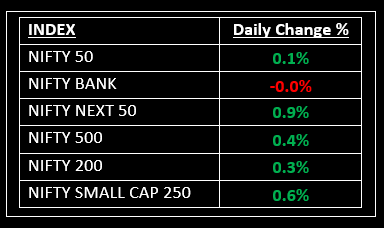

NIFTY: The index opened 23 points higher at 20,929 and made a high of 20,950 before closing at 20,926. Nifty has formed a Doji candlestick pattern on the daily chart. Its immediate resistance level is now placed at 21,020 while immediate support is at 20,850.

BANK NIFTY: The index opened 93 points higher at 47,190 and closed at 47,092. Bank Nifty has formed a bearish candlestick pattern with a long lower shadow on the daily chart. Its immediate resistance level is now placed at 47,350 while support is at 46,900.

Stocks in Spotlight

▪ Adani Total Gas: Stock tanked 10%, after a 90% rally in the last month, as investors booked profits.

▪ HPL Electric & Power: Stock surged 10% after the company bagged an order worth Rs 545 crore for smart meters, supporting India's national metering initiative.

▪ Equitas Small Finance Bank: Stock gained over 3% intraday after it announced the appointment of Ashwini Biswal as its next chief compliance officer (CCO).

Global News

▪ Gold extended gains on Wednesday, as subdued Treasury yields boosted the bullion’s appeal.

▪ The dollar edged up against the euro ahead of the conclusion of a Federal Reserve policy meeting that could offer some insight into when the US central bank will begin lowering interest rates.

▪ China stocks led declines among Asia-Pacific markets as investors digested Beijing’s plan to boost domestic demand, while European markets were slightly higher.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and/or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.