POST-MARKET SUMMARY 12th March 2025

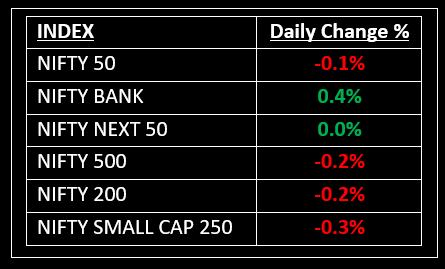

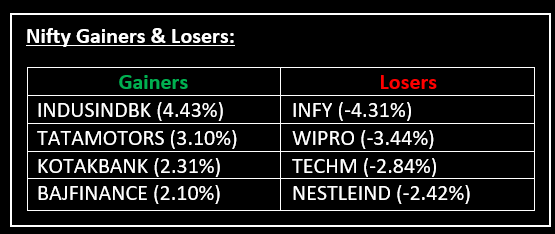

On March 12, in a highly volatile session, benchmark indices Sensex and Nifty ended marginally lower as gains in banking and automobile shares were offset by losses in the IT sector. Top Gainer: INDUSINDBK | Top Loser: INFY

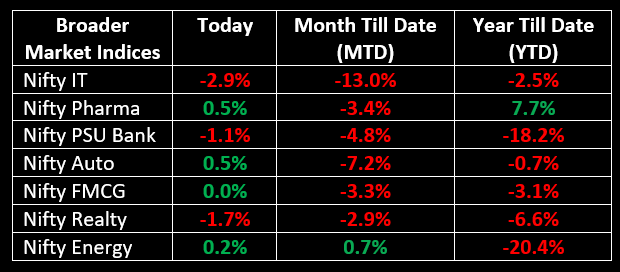

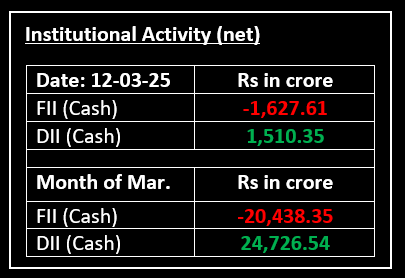

On March 12, in a highly volatile session, benchmark indices Sensex and Nifty ended marginally lower as gains in banking and automobile shares were offset by losses in the IT sector. Global markets have been volatile, with the US President pressuring trade partners through tariff barriers. Auto and Pharma sectors emerged as top performers, while the IT sector saw a sharp decline of nearly 3%.

NIFTY: The index opened 39 points higher at 22,536 and made a high of 22,577 before closing at 22,470. Nifty has formed a bearish candle with a long lower shadow on the daily chart. Its immediate resistance level is now placed at 22,580 while its major support is at 22,300.

BANK NIFTY: The index opened 41 points higher at 47,894 and closed at 48,056. Bank Nifty has formed a bullish candle with an upper shadow on the daily chart. Its immediate resistance level is now placed around 48,200 while immediate support is around 47,700.

Stocks in Spotlight

▪ Ola Electric: Stock climbed 2% after the company announced the successful completion of its company-wide cost-reduction initiative, titled the ‘Network Transformation and Opex Reduction Programme.’

▪ PB Fintech: Stock tumbled over 5% after announcing a Rs 696 crore investment in its subsidiary PB Healthcare Services.

▪ Kaynes Tech: Stock plunged 8% in early trade, following news that the SEBI issued a show-cause notice to the company’s Managing Director, Ramesh Kunhikannan, over insider trading allegations.

Global News

▪ Asia-Pacific markets were mixed on Wednesday, following a volatile day on Wall Street due to uncertainty over U.S. President Donald Trump’s tariff plans and fears of a recession in the world’s largest economy.

▪ European markets saw broad gains on Wednesday after the European Union announced retaliatory tariffs on U.S. imports of steel and aluminium.

▪ U.S. stock index futures gained sharply on Wednesday after signs of cooling inflation provided investors some relief as they look for clues on the Federal Reserve's monetary policy trajectory this year.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and/or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.