POST-MARKET SUMMARY 12th March 2024

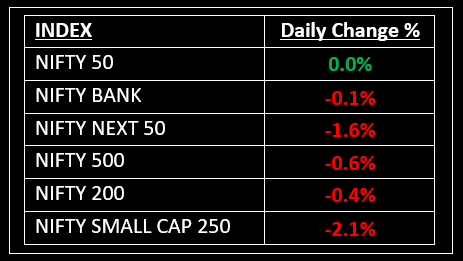

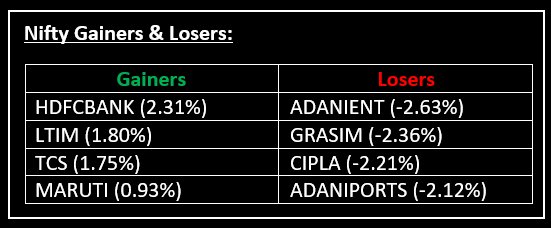

On March 12, in another session marked by volatility, the Indian benchmark indices closed flat, with the Nifty ending at 22,335.70. Top Gainer: HDFCBANK | Top Loser: ADANIENT

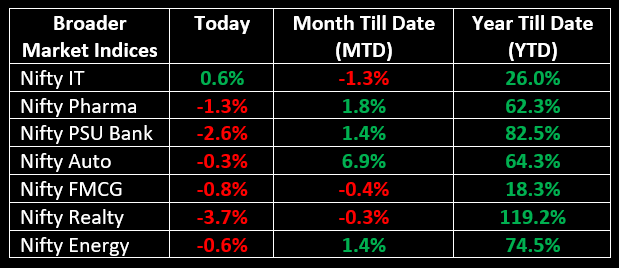

On March 12, in another session marked by volatility, the Indian benchmark indices closed flat, with the Nifty ending at 22,335.70. Commencing with a flat to positive opening, the market saw an extension of gains as the day progressed. However, profit-booking ensued amidst broad-based selling across various sectors. On the sectoral front, with the exception of IT, all other indices concluded in negative territory, with the realty index declining by nearly 3.5%, PSU Bank and Media indices falling by 2% each, and capital goods, FMCG, healthcare, metal, and power indices experiencing a 1% decline each.

NIFTY: The index opened flat at 22,334 and made a high of 22,452 before closing at 22,335. Nifty has formed a Doji candlestick pattern on the daily chart. Its immediate resistance level is now placed at 22,400 while immediate support is at 22,250.

BANK NIFTY: The index opened 24 points higher at 47,351 and closed at 47,282. Bank Nifty has formed a Doji or High Wave kind of candlestick pattern on the daily chart. Its immediate resistance level is now placed at 47,500 while support is at 46,900.

Stocks in Spotlight

▪ Aditya Birla Capital Ltd: Stock gained over 2%, a day after the board of directors of Aditya Birla Capital Limited approved the merger of Aditya Birla Finance Ltd with itself.

▪ Aurobindo Pharma: Stock fell nearly 2% even though the company's subsidiary received WHO GMP approval.

▪ KFin Technologies: Stock slumped 5.6% after around 36 lakh shares, making up a 2.1% stake, changed hands in a Rs 211-crore block deal

Global News

▪ The Stoxx 600 index shook off some of Monday’s negativity to trade 0.8% higher following the U.S. consumer price index print, extending the morning’s gains. Sectors were mainly in the green, with auto up 2%, while utilities fell 0.8%.

▪ Gold edged further away from a record peak on Tuesday as it looks set to break nine straight sessions of gains after the latest U.S. inflation data.

▪ The U.S. dollar was higher in choppy trading on Tuesday amid data showing hotter-than-expected inflation last month for the world’s largest economy.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and/or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.