POST-MARKET SUMMARY 12 July 2023

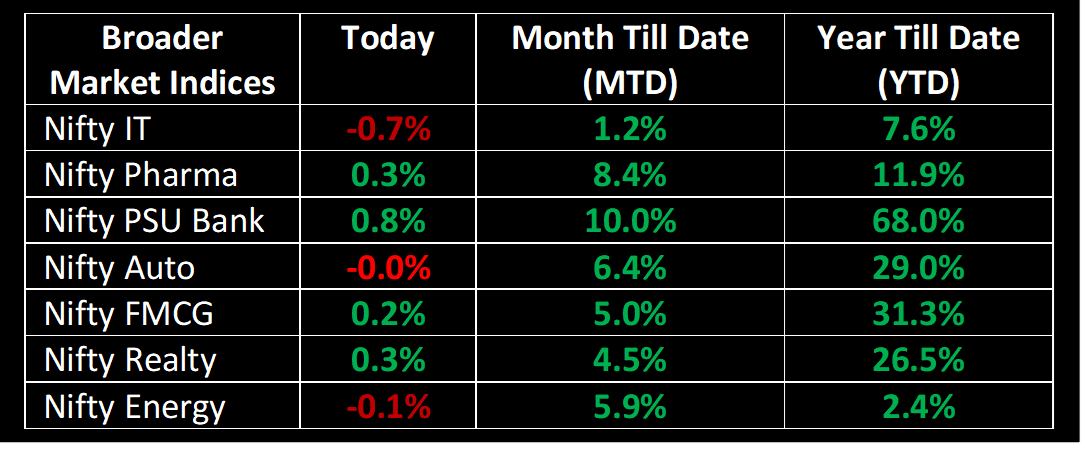

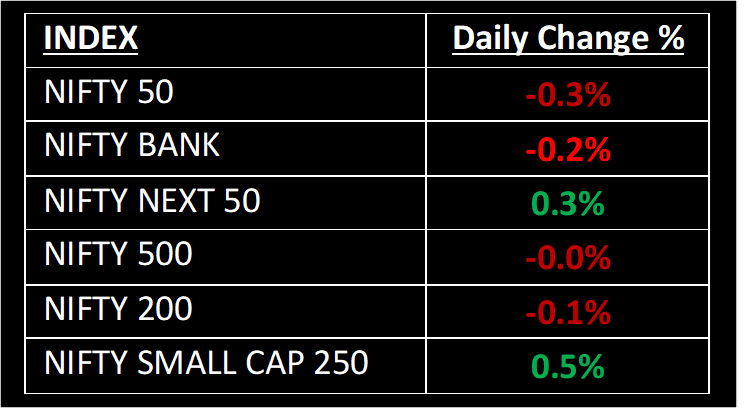

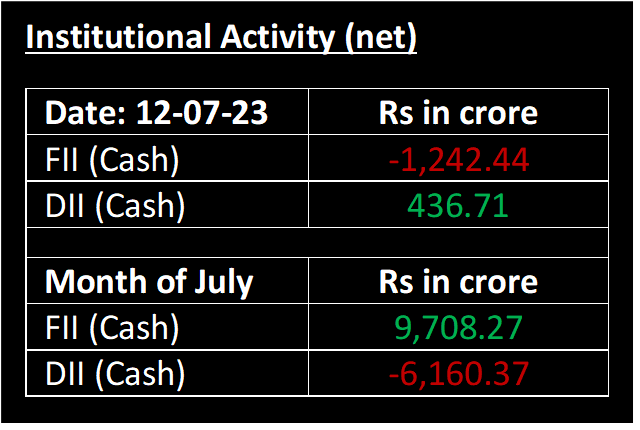

On July 12, the Nifty saw a downward move erasing a significant portion of the previous day's gains amid a volatile trading session. The index slipped below 19,400 due to selling pressure in IT stocks, as investors anticipated subdued earnings. Meanwhile, broader market indices performed relatively better and concluded the day with gains. Certain stocks Delta Corp, Nazara Tech were adversely impacted by alterations in GST tax rates.

NIFTY: The index opened 58 points higher at 19,497 and made a high of 19,507 before closing at 19,384. Nifty has formed a small bearish candle and a lower top formation on the intraday chart. Its immediate resistance level is now placed at 19,500 while immediate support is at 19,300.

BANK NIFTY: The index opened 127 points higher at 44,872 and closed at 44,639. Bank Nifty has formed a bearish candle on the daily chart, which indicates weakness in the near term. Its immediate resistance level is now placed at 45,000 while support is at 44,300.

Stocks in Spotlight

▪ Delta Corp Ltd: Stock tumbled 23% after the GST Council decided that online gaming, casinos, and horse racing will be taxed at 28%.

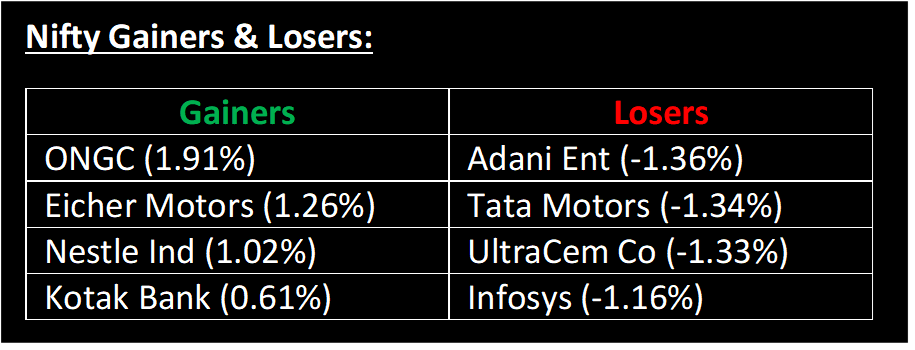

▪ Adani Enterprises Ltd: Stock slipped 1.4%, a day after the company announced that it has raised Rs 1,250 crore through allotment of non-convertible debentures (NCDs).

▪ HCL Technologies: Company recorded a year-on-year (YoY) increase of 7.6% in net profit. However, compared to the previous quarter, net profit declined by 11.2%.

Global News

▪ Gold prices were firmer near three-week highs on Wednesday ahead of the much-awaited US inflation data that could drive the Federal Reserve’s upcoming interest rate decisions.

▪ European markets advanced on Wednesday afternoon as investors reacted to a cooler-than-expected US inflation reading, which could have significant bearing on the Federal Reserve’s interest rate path.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and / or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.