POST-MARKET SUMMARY 11th March 2025

On March 11, Indian equity indices ended on a flat note after a volatile session. Top Gainer: TRENT | Top Loser: INDUSIND

On March 11, Indian equity indices ended on a flat note after a volatile session. On the back of negative global cues, the indices opened weak, with the Nifty slipping below 22,350, dragged down by banking stocks, including IndusInd Bank, which fell 10% in early trade. However, the Nifty saw a sharp recovery from the day's low to close with marginal gains.

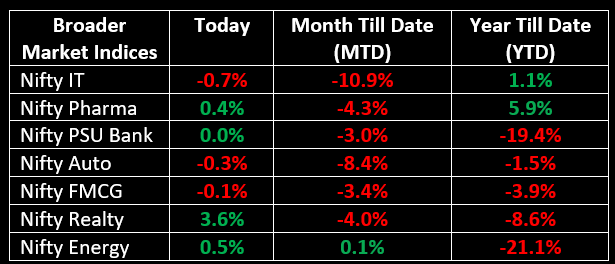

Among sectors, metal, realty, telecom, and oil & gas rose 0.5-3%, while auto, IT, and banking stocks declined.

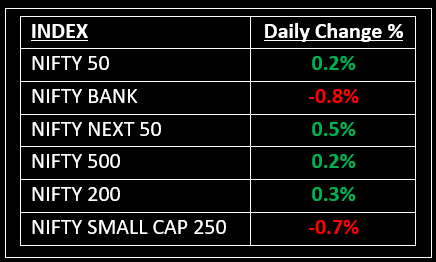

NIFTY: The index opened 115 points lower at 22,345 and made a high of 22,522 before closing at 22,497. Nifty has formed a bullish candlestick pattern on the daily chart. Its immediate resistance level is now placed at 22,620 while its immediate support is at 22,400.

BANK NIFTY: The index opened 342 points lower at 47,874 and closed at 47,853. Bank Nifty has formed a Doji-like candlestick pattern on the daily chart. Its immediate resistance level is now placed around 48,000 while immediate support is around 47,700.

Stocks in Spotlight

▪ Macrotech Developers: Stock surged over 5% after the company sealed a deal to acquire a 3.4-acre land parcel in Mumbai’s Jogeshwari West suburb from Unichem Laboratories for more than Rs 279 crore.

▪ Bharat Electronics Ltd: Stock rose about 2% after securing fresh orders worth Rs 843 crore.

▪ Gensol Engineering: Stock extends losses by 5% as promoter infusion of Rs 29 crore fails to excite.

Global News

▪ European markets traded lower on Tuesday as global markets buckle amid anxiety that the U.S. economy will suffer because of President Donald Trump’s trade tariff policies.

▪ Asia-Pacific markets slid on Tuesday, tracking losses in the U.S. following anxiety over tariff policy and a potential recession in the world's largest economy.

▪ US stocks staged a partial recovery after the recent market rout, with the benchmark Nasdaq Composite inching higher led by gains in AI giant Nvidia and Tesla in early trade.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and/or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.