POST-MARKET SUMMARY 11th June 2025

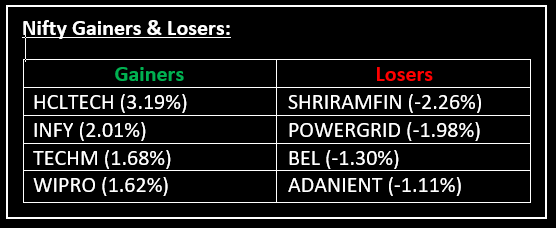

On June 11, the bulls returned, pushing Nifty to cross 25,200 intraday for the first time since October 15, 2024. The markets started the day on a muted note but surged higher later in the day, driven by strength in IT stocks. Top Gainer: HCLTECH | Top Loser: SHRIRAMFIN

On June 11, the bulls returned, pushing Nifty to cross 25,200 intraday for the first time since October 15, 2024. The markets started the day on a muted note but surged higher later in the day, driven by strength in IT stocks.

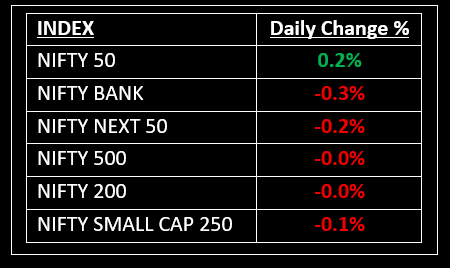

However, overbought conditions in the Midcap and Smallcap segments triggered a fall. Despite this, the index managed to recover from lower levels to close with marginal gains.

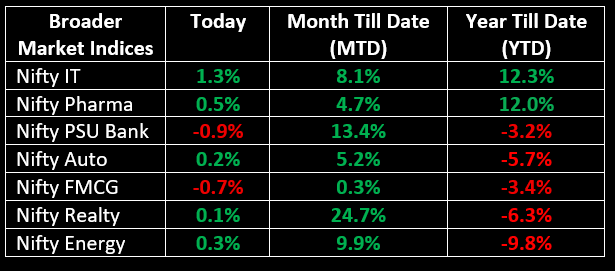

Sector-wise, FMCG and and PSU Banks saw a decline of 0.5-1%, while Oil & Gas, Pharma, and IT stocks gained 0.5-1.5%.

NIFTY: The index opened 30 points higher at 25,134 and made a high of 25,222 before closing at 25,141. Nifty has formed a small indecisive candle on the daily chart. Its immediate resistance level is now placed at 25,230 while immediate support is at 25,000.

BANK NIFTY: The index opened flat at 56,639 and closed at 56,459. Bank Nifty has formed a bearish candle on the daily chart. Its immediate resistance level is now placed around 56,650 while immediate support is around 56,150.

Stocks in Spotlight

▪ Waaree Energies: Stock gained nearly 2% after the company’s subsidiary secured an order to supply 599 MW of solar modules.

▪ Talbros Automotive Components: Stock rose over 2%, following news that the company, along with its JVs, secured Rs 580 crore worth of orders from leading OEMs for both domestic and export markets.

▪ BSE: Stock fell over 4%, marking its largest single-day decline in three weeks, after being placed under the Additional Surveillance Measure (ASM) framework

Global News

▪ European and Asian stock markets mostly rose on Wednesday following the announcement that China and the U.S. had agreed on a framework to follow up on last month's trade truce in Geneva.

▪ Oil prices reached a seven-week high, supported by market reactions to the U.S.-China trade talks, while ongoing pessimism over U.S.-Iran nuclear negotiations also provided a boost.

▪ Gold prices firmed as investors adopted a cautious stance, awaiting key inflation data for insights into the Federal Reserve's potential interest rate moves.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and/or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.