POST-MARKET SUMMARY 11th July 2025

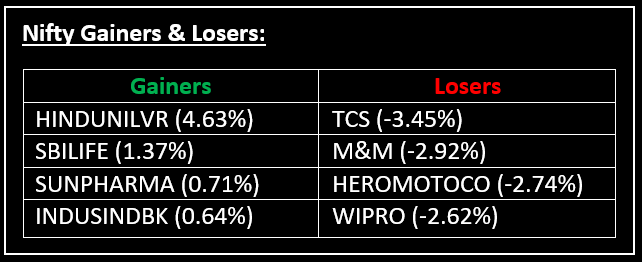

On July 11, benchmark equity indices extended their losing streak for the third consecutive session, weighed down by weak global cues. Top Gainer: HINDUNILVR | Top Loser: TCS

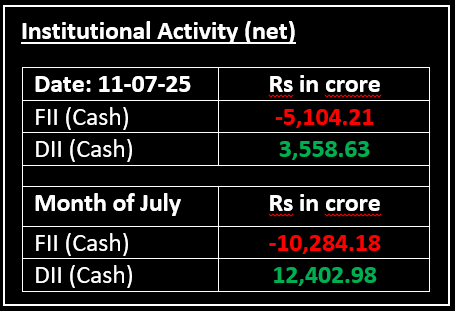

On July 11, benchmark equity indices extended their losing streak for the third consecutive session, weighed down by weak global cues. Investor sentiment remained subdued due to ongoing uncertainties surrounding tariff-related issues and a weak start to the earnings season. The session opened negatively, driven by disappointing results from IT major TCS, followed by profit-taking in heavyweight stocks across various sectors.

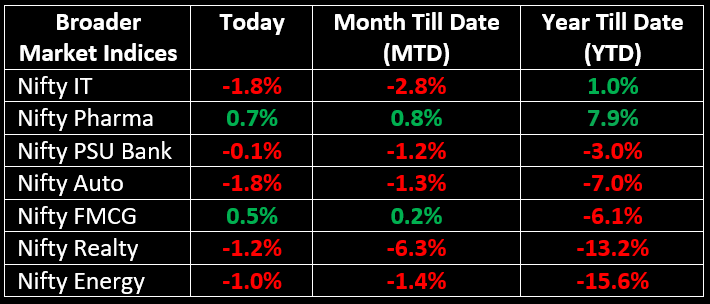

While FMCG (up 0.5%) and Pharma (up 0.7%) managed to show some resilience, all other sectoral indices closed in the red, with IT, Auto and Realty stocks emerging as the top losers.

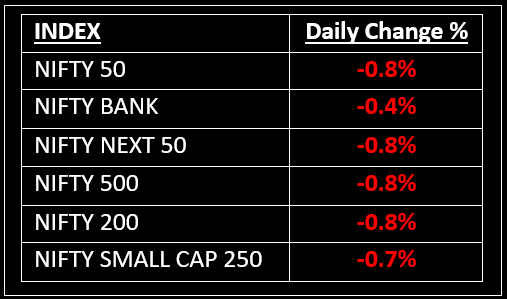

NIFTY: The index opened 100 points lower at 25,255 and made a high of 25,322 before closing at 25,149. Nifty has formed a bearish candle with an upper shadow on the daily chart. Its immediate resistance level is now placed at 25,250 while major support is at 25,000.

BANK NIFTY: The index opened 113 points lower at 56,843 and closed at 56,754. Bank Nifty has formed a bearish candle with a long upper shadow and a small lower shadow on the daily chart. Its immediate resistance level is now placed around 56,900 while immediate support is around 56,600.

Stocks in Spotlight

▪ Glenmark Pharmaceuticals: Stock surged nearly 15% following the news that Glenmark's subsidiary, Ichnos Glenmark Innovation, entered into an exclusive licensing agreement with AbbVie for ISB-2001, a tri-specific antibody aimed at treating multiple myeloma.

▪ R.P.P. Infra Projects: Stock rose by 2.7% after the company secured orders worth Rs 365 crore in Rajasthan.

▪ Anand Rathi Wealth: Stock jumped over 4% after the company reported a 28% increase in net profit, reaching Rs 93.9 crore for Q4, while revenue grew by 15% YoY to Rs 274 crore.

Global News

▪ European stocks declined on Friday after U.S. President Donald Trump escalated his tariff war against Canada, putting Europe in the crosshairs of potential trade disruptions.

▪ Oil prices saw a modest uptick as investors weighed the current tight supply against the possibility of a large surplus later in the year, as per the International Energy Agency's outlook. The focus also remained on U.S. tariffs and the potential for further sanctions on Russia.

▪ Gold prices rose for the third consecutive session, driven by increased demand for the safe-haven asset following Trump’s new tariff threats against Canada and other trading partners.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and/or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.