POST-MARKET SUMMARY 11th February 2025

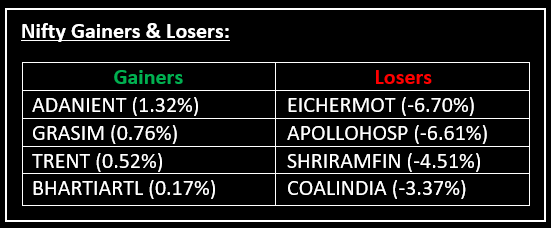

On February 11, Indian markets closed lower, tracking global weakness as fresh tariff developments fuelled investor caution. Top Gainer: ADANIENT | Top Loser: EICHERMOT

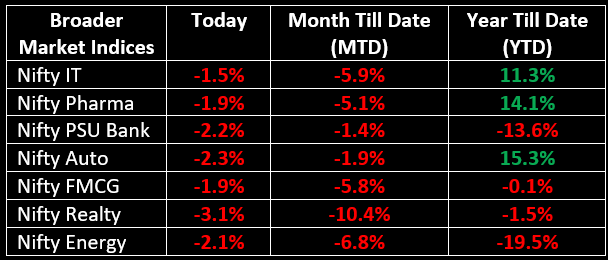

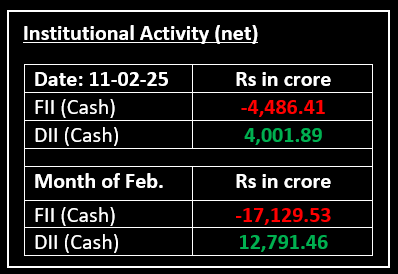

On February 11, Indian markets closed lower, tracking global weakness as fresh tariff developments fuelled investor caution. Traders are closely watching Fed Chair Powell’s testimony and key US inflation data for further cues. Sectorally, realty fell over 3%, while media, auto, and pharma also saw notable declines.

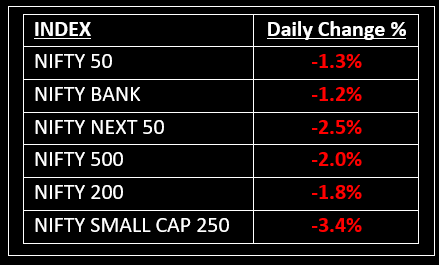

NIFTY: The index opened flat at 23,383 and made a high of 23,390 before closing at 23,071. Nifty has formed a bearish candle on the daily chart. Its immediate resistance level is now placed at 23,150 while its immediate support is at 23,000.

BANK NIFTY: The index opened 169 points lower at 49,812 and closed at 49,403. Bank Nifty has formed a bearish candle on the daily chart. Its immediate resistance level is now placed around 49,600 while immediate support is around 49,180.

Stocks in Spotlight

▪ Tilaknagar Industries: Stock plunged almost 5% after the Bombay High Court dismissed a plea challenging other firms use of its trademarked brand names, 'Mansion House' and 'Savoy Club', on their products.

▪ Devyani International: Stock fell over 4% after the company posted a ₹49.2 lakh loss for the December quarter, reversing from a ₹9.6 crore profit a year ago.

▪ Juniper Hotels: Stock slipped 2% despite a strong Q3 earnings report, with net profit surging to ₹32.5 crore from ₹3.5 crore a year ago. The 7% revenue growth was offset by a decline in EBITDA and contracting margins.

Global News

▪ European markets were trading flat on Tuesday morning, paring earlier gains as investors digested the latest raft of tariffs introduced by U.S. President Donald Trump.

▪ The 10-year US Treasury yield rose to 4.52%, a one-week high, as traders awaited Fed Chair Powell's testimony for policy insights. Last month, the Fed paused rate cuts, with Powell signalling no rush to ease rates amid inflation concerns.

▪ Gold shot to a record high and Asian stocks were subdued on Tuesday as investors braced for further shifts in U.S. trade policy and waited to hear from Federal Reserve Chair Jerome Powell on tariffs and inflation.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and/or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.