POST-MARKET SUMMARY 10th May 2024

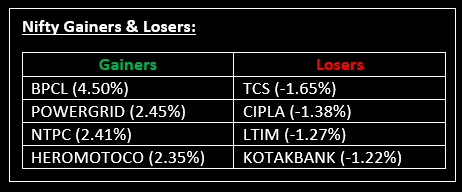

On May 10, the Sensex jumped over 260 points while the Nifty closed above the 22000 mark, tracking gains in global equity markets. Top Gainer: BPCL | Top Loser: TCS

On May 10, the Sensex jumped over 260 points while the Nifty closed above the 22000 mark, tracking gains in global equity markets. The surge in global equity markets was driven by prospects of Fed rate cuts, triggered by a surge in US jobless claims, hitting a nine-month high. Analysts suggest that the Fed may cut rates this year, contingent upon further evidence of easing inflation.

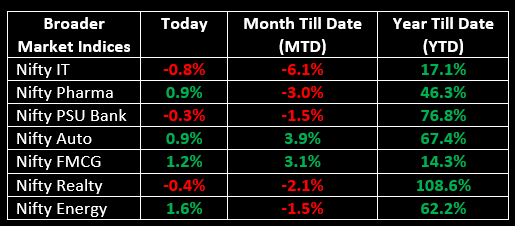

Leading the gains, Nifty Metal rose by 1.5%, followed by FMCG, Auto, and Pharma, each up by 1%. On the downside, Nifty IT recorded losses of 0.8%, while both Nifty Realty and Nifty PSU Bank were down by 0.4% and 0.3%, respectively.

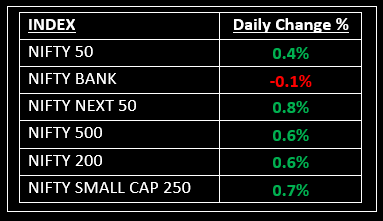

NIFTY: The index opened 33 points higher at 21,990 and made a high of 22,131 before closing at 22,055. Nifty has formed a small bullish candle on the daily chart. Its immediate resistance level is now placed at 22,130 while immediate support is at 21,980.

BANK NIFTY: The index opened 68 points higher at 47,555 and closed at 47,421. Bank Nifty has formed a small bearish candle the daily timeframe. Its immediate resistance level is now placed at 47,750 while support is at 47,250.

Stocks in Spotlight

▪ Vijaya Diagnostics: Stock surged over 10% to hit a new high of Rs 818 as investors cheered for the company's steady performance in the March quarter.

▪ Cipla: Stock fell 3% after the company reported lower-than-expected revenue and margin numbers for the March quarter.

▪ BPCL: Stock gained 4% on May 10 even as the company's Q4 earnings missed street expectations on lower refining margins.

Global News

▪ European shares were set to post their biggest weekly gain since late January, with the pan-regional STOXX 600 index headed to its sixth straight session of gains.

▪ U.S. Treasury yields were slightly higher on Friday as traders digested the jump in weekly jobless claims and what this could mean for interest rates.

▪ The dollar steadied on Friday after losing ground overnight on the back of U.S. data showing further signs of a cooling labour market, while the yen dipped as investors pushed back after suspected intervention last week.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and/or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.