POST-MARKET SUMMARY 10th March 2025

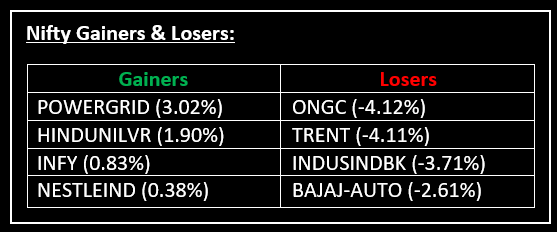

On March 10, Indian indices closed lower after a volatile session, despite trading higher in the first half. Top Gainer: POWERGRID | Top Loser: ONGC

On March 10, Indian indices closed lower after a volatile session, despite trading higher in the first half. Both Sensex and Nifty erased early gains and slipped into the red as profit-booking in the latter half, combined with weak global cues, weighed on investor sentiment. The sell-off was driven by concerns over a sharp decline in US stock futures, renewed trade tensions, and weak cues from Asian markets.

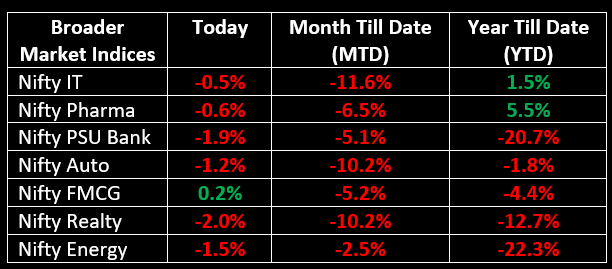

Except for FMCG, all sectoral indices declined, with Auto, Consumer Durables, Metal, Capital Goods, Oil & Gas, Realty, and PSU Bank falling 1-2%.

NIFTY: The index opened 31 points lower at 22,521 and made a high of 22,676 before closing at 22,460. Nifty has formed a bearish candle with a long upper shadow, resembling a Shooting Star pattern on the daily chart. Its immediate resistance level is now placed at 22,520 while its immediate support is at 22,400.

BANK NIFTY: The index opened 185 points lower at 48,312 and closed at 48,216. Bank Nifty has formed a bearish candle on the daily chart. Its immediate resistance level is now placed around 48,400 while immediate support is around 48,000.

Stocks in Spotlight

▪ Bodal Chemicals: Stock surged 15% after the government imposed an anti-dumping duty on Trichloro Isocyanuric Acid (TCCA) imports, which is likely to boost the company’s bottom-line.

▪ IREDA: Stock fell over 3% after the RBI rejected the company's request for equity investment in Nepal’s 900 MW Upper Karnali Hydropower Project.

▪ HFCL: Stock surged 4% intraday after its subsidiary secured a Rs 44.36 crore contract from the Indian Army. The deal includes tactical optical fibre cable assemblies with ruggedized cables and military-grade connectors designed for extreme conditions.

Global News

▪ European shares opened flat on Monday as investors took a breather after a week of high volatility driven by uncertainties surrounding U.S. tariffs.

▪ The British pound traded around $1.29, hovering near four-month highs, supported by broad dollar weakness amid concerns about the U.S. economy and the potential impact of upcoming tariffs.

▪ U.S. natural gas futures surged nearly 5% to $4.60 per million British thermal units (MMBtu), their highest level since December 2022, fuelled by extreme weather, supply constraints, record LNG exports, and geopolitical tensions.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and/or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.