POST-MARKET SUMMARY 10th June 2025

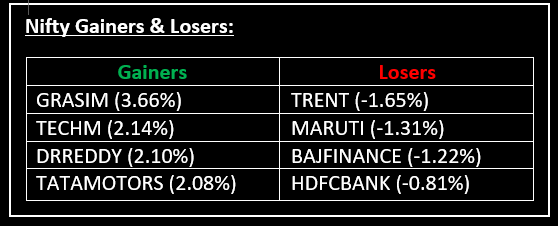

On June 10, the market struggled to maintain early gains and ended flat after a volatile session, as profit booking set in following recent advances. Top Gainer: GRASIM | Top Loser: TRENT

On June 10, the market struggled to maintain early gains and ended flat after a volatile session, as profit booking set in following recent advances. With most positive factors already priced in, investor attention now shifts to the US-China trade talks and inflation data for both the US and India, set to be released this week.

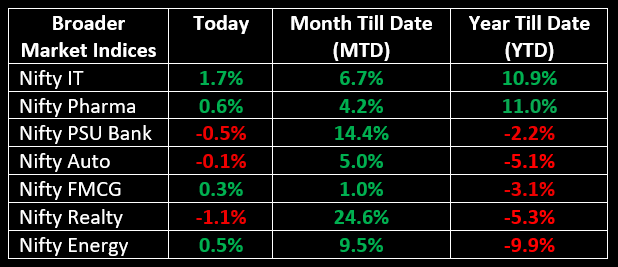

Sector-wise, the performance was mixed. Realty led the decline, dropping 1.14%, while the banking sectors also faced losses, with PSU Banks falling 0.52% and Private Banks down by 0.17%. Financial Services slipped 0.47%. On the flip side, IT and Media sectors stood out, posting healthy gains of 1.67% and 1.09%, respectively.

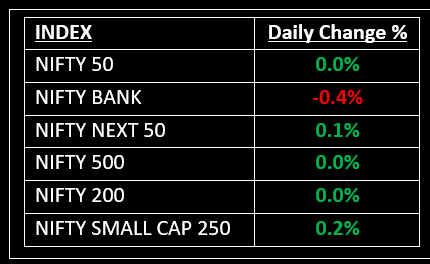

NIFTY: The index opened flat at 25,103 and made a high of 25,111 before closing at 25,091. Nifty has formed a bearish candlestick pattern on the daily chart. Its immediate resistance level is now placed at 25,200 while its immediate support is at 25,000.

BANK NIFTY: The index opened flat at 56,648 and closed at 56,579. Bank Nifty has formed a bearish candlestick pattern on the daily charts. Its immediate resistance level is now placed around 56,800 while immediate support is around 56,400.

Stocks in Spotlight

▪ Swiggy: Shares dropped over 2% after reports revealed a competitor launched a pilot food delivery project in Bengaluru with a flat commission fee of 8-15%, much lower than the 15-30% charged by industry leaders.

▪ Jindal Saw: Shares surged nearly 7% after the company’s board approved $118 million in international investments to strengthen its foothold in the Middle East’s iron and steel sector. This strategic move is set to expand its market presence and drive future growth.

▪ NBCC: Shares slipped by 3% despite securing an order worth over ₹50 crore from the Ministry of Tourism to develop a temple in Himachal Pradesh. The project is expected to boost the company’s portfolio, but the market response was cautious.

Global News

▪ European markets saw a decline on Tuesday, with major indices retreating by 0.4% and 0.3%. Investors remained cautious, awaiting further developments in the ongoing trade talks between the US and China, which entered their second day. While no significant breakthroughs were reported after the initial round of discussions, US officials conveyed a sense of optimism regarding the negotiations.

▪ Asian markets ended slightly lower on Tuesday, reversing earlier gains as declines in the tech and consumer sectors dampened sentiment. Some traders took profits after the market reached a near three-month high in the previous session.

▪ Gold prices remained stable at \$3,320 per ounce on Tuesday, as investors awaited updates from the ongoing US-China trade talks. The discussions, which began in London on Monday, aimed to stabilize a fragile truce amidst tensions over tariffs and rare earth element restrictions.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and/or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.