POST-MARKET SUMMARY 10th June 2024

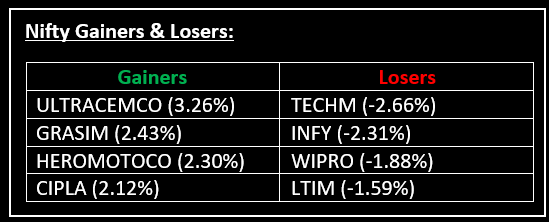

On June 10, the market snapped a three-day winning streak and ended lower in a volatile session, with Nifty closing around 23,250, mostly dragged down by information technology stocks. Top Gainer: ULTRACEMCO | Top Loser: TECHM

On June 10, the market snapped a three-day winning streak and ended lower in a volatile session, with Nifty closing around 23,250, mostly dragged down by information technology stocks. Investors are also awaiting the release of US inflation data and the Federal Reserve’s policy meeting on June 12. The FOMC will update its summary of economic projections and dot plot, revealing whether its views align with market expectations for interest rate cuts.

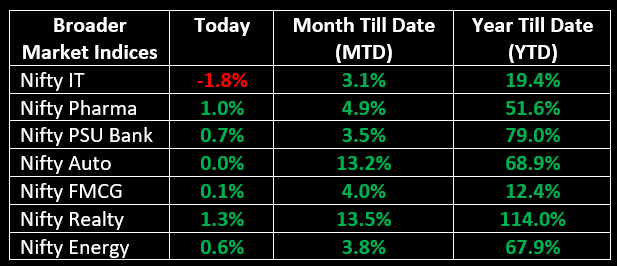

Among sectoral indices, Nifty Media was the biggest gainer, up 1.9%, followed by Nifty Realty and Pharma, which gained 1.3% and 1% respectively. Nifty Consumer Durables and Healthcare were up 0.7% each. On the other hand, the Nifty IT Index fell 1.8%.

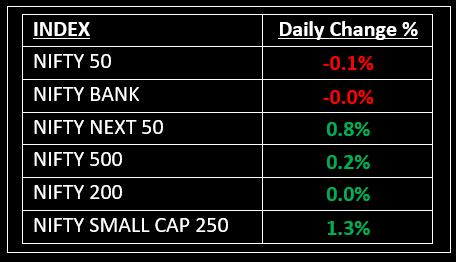

NIFTY: The index opened flat at 23,319 and made a high of 23,411 before closing at 23,259. Nifty has formed a small bearish candlestick pattern on the daily chart. Its immediate resistance level is now placed at 23,360 while immediate support is at 23,150.

BANK NIFTY: The index opened flat at at 49,808 and closed at 49,780. Bank Nifty has formed a bearish candle with a long upper body on the daily timeframe. Its immediate resistance level is now placed at 50,000 while support is at 49,600.

Stocks in Spotlight

▪ Raymond: Stock gained 3.5% to a record high after the company's real estate division was declared as preferred developer for a redevelopment project in Bandra, Mumbai.

▪ KEC International: Stock jumped 5.2% after the company secured new orders of Rs 1,061 crore across its various businesses.

▪ Suzlon: Stock slumped 5% as an Independent Director at the company, Marc Desaedeleer, resigned from his post with effect from June 8, citing corporate governance issues.

Global News

▪ U.S. Treasury yields were higher on Monday as investors looked ahead to the Federal Reserve’s monetary policy meeting and key inflation data due this week.

▪ Gold prices held steady on Monday after a sharp sell-off in the previous session on stronger-than-expected U.S. jobs data, with investors awaiting the Federal Reserve policy meeting this week for further direction.

▪ European stocks fell as traders reacted to initial results from the EU vote and French President Emmanuel Macron’s shock call for parliamentary elections.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and/or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.