POST-MARKET SUMMARY 10th July 2024

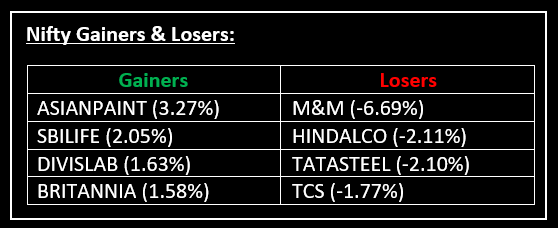

On July 10, the benchmark indices Sensex and Nifty retreated from a record high in the previous session, influenced by price cuts from a major automaker and anticipation surrounding the upcoming earnings season. Top Gainer: ASIANPAINT | Top Loser: M&M

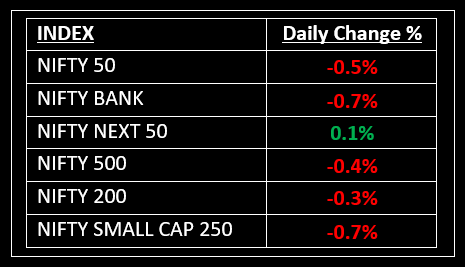

On July 10, the benchmark indices Sensex and Nifty retreated from a record high in the previous session, influenced by price cuts from a major automaker and anticipation surrounding the upcoming earnings season. Investors are also eyeing the upcoming Budget for further cues. At closing, the benchmark Sensex fell 0.53% to 79,924.77 points, while Nifty declined 0.45% to 24,324.45 points.

In other news, SEBI unveiled sweeping recommendations to reform F&O regulations, which could dramatically alter the trading landscape in the Derivates market. Read More: F&O Alert: SEBI Committee Recommends Stricter Regulations to Control Trading Volumes

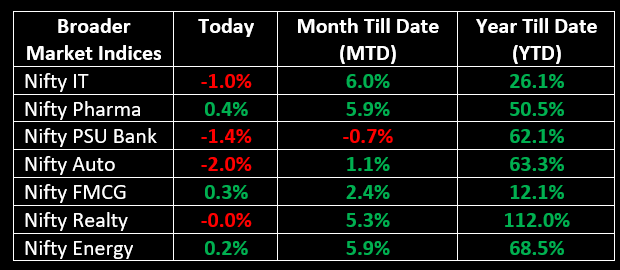

Among sectoral indices, the Nifty Auto index led losses, falling 2%, followed by the Nifty Metal and PSU Bank indices, which declined by 1.6% and 1.4%, respectively. The Nifty IT index was down 1%, while the Nifty Bank index slipped by 0.7%.

NIFTY: The index opened 26 points higher at 24,459 and made a high of 24,461 before closing at 24,324. Nifty has formed a Bearish Engulfing candlestick pattern on the daily chart. Its immediate resistance level is now placed at 24,400 while immediate support is at 24,260.

BANK NIFTY: The index opened 40 points lower at 52,528 and closed at 52,189. Bank Nifty has formed a Bearish candle on the daily chart. Its immediate resistance level is now placed at 52,400 while support is at 52,000.

Stocks in Spotlight

▪ Delta Corp: Stock fell over 4% intraday to Rs 136 after the company reported disappointing results for the June quarter due to higher GST rates, general elections, and seasonal factors.

▪ BLS International Services: Stock jumped ~5% in early trade after the company's arm completed acquisition of 100% stake in a Turkey-based company.

▪ Rail Vikas Nigam: Stock surged 10% intraday on winning orders worth Rs 389 crore.

Global News

▪ European stocks were higher on Wednesday as investors turn their attention stateside after a week of political drama.

▪ Gold prices edged up, a day after Federal Reserve Chair Jerome Powell’s comments suggested that the case for interest rates cuts is getting stronger, while investors braced themselves for a crucial U.S. inflation report.

▪ The pound held near one-month highs, supported by the belief among investors that U.S. interest rates are set to fall sooner than many had predicted, which dented the dollar.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and/or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.